Page 106 - Learn Africa 2021 Annual Report

P. 106

Learn Africa Plc

Notes to the Financial Statements (cont’d)

For the year ended 31 March 2021

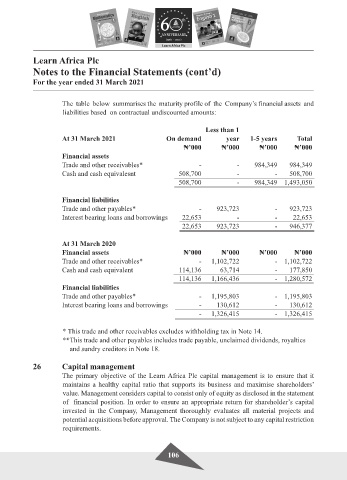

The table below summarises the maturity profile of the Company’s financial assets and

liabilities based on contractual undiscounted amounts:

Less than 1

At 31 March 2021 On demand year 1-5 years Total

₦’000 ₦’000 ₦’000 ₦’000

Financial assets

Trade and other receivables* - - 984,349 984,349

Cash and cash equivalesnt 508,700 - - 508,700

508,700 - 984,349 1,493,050

Financial liabilities

Trade and other payables* - 923,723 - 923,723

Interest bearing loans and borrowings 22,653 - - 22,653

22,653 923,723 - 946,377

At 31 March 2020

Financial assets ₦’000 ₦’000 ₦’000 ₦’000

Trade and other receivables* - 1,102,722 - 1,102,722

Cash and cash equivalent 114,136 63,714 - 177,850

114,136 1,166,436 - 1,280,572

Financial liabilities

Trade and other payables* - 1,195,803 - 1,195,803

Interest bearing loans and borrowings - 130,612 - 130,612

- 1,326,415 - 1,326,415

* This trade and other receivables excludes withholding tax in Note 14.

**This trade and other payables includes trade payable, unclaimed dividends, royalties

and sundry creditors in Note 18.

26 Capital management

The primary objective of the Learn Africa Plc capital management is to ensure that it

maintains a healthy capital ratio that supports its business and maximise shareholders’

value. Management considers capital to consist only of equity as disclosed in the statement

of financial position. In order to ensure an appropriate return for shareholder’s capital

invested in the Company, Management thoroughly evaluates all material projects and

potential acquisitions before approval. The Company is not subject to any capital restriction

requirements.

106