Page 87 - Learn Africa 2021 Annual Report

P. 87

Learn Africa Plc

Notes to the Financial Statements (cont’d)

For the year ended 31 March 2021

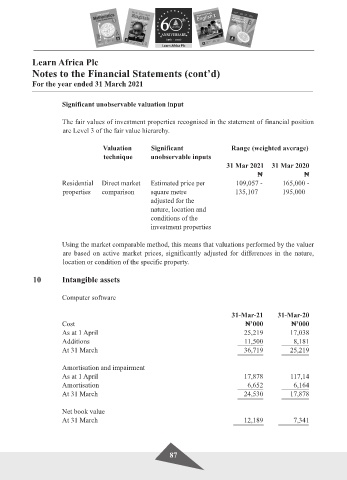

Significant unobservable valuation input

The fair values of investment properties recognised in the statement of financial position

are Level 3 of the fair value hierarchy.

Valuation Significant Range (weighted average)

technique unobservable inputs

31 Mar 2021 31 Mar 2020

$ $

Residential Direct market Estimated price per 109,057 - 165,000 -

properties comparison square metre 135,107 195,000

adjusted for the

nature, location and

conditions of the

investment properties

Using the market comparable method, this means that valuations performed by the valuer

are based on active market prices, significantly adjusted for differences in the nature,

location or condition of the specific property.

10 Intangible assets

Computer software

31-Mar-21 31-Mar-20

Cost $’000 $’000

As at 1 April 25,219 17,038

Additions 11,500 8,181

At 31 March 36,719 25,219

Amortisation and impairment

As at 1 April 17,878 117,14

Amortisation 6,652 6,164

At 31 March 24,530 17,878

Net book value

At 31 March 12,189 7,341

87