Page 89 - Learn Africa 2021 Annual Report

P. 89

Learn Africa Plc

Notes to the Financial Statements (cont’d)

For the year ended 31 March 2021

Inventory write-down that was recognised in cost of sales for the year ended 31 March

2021 was $5,456,800 (31 March 2020: $78,705,993). Inventories are valued at the lower

of cost and net realisable value less costs to sales.

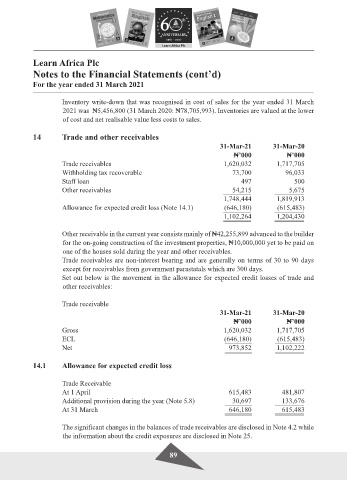

14 Trade and other receivables

31-Mar-21 31-Mar-20

$’000 $’000

Trade receivables 1,620,032 1,717,705

Withholding tax recoverable 73,700 96,033

Staff loan 497 500

Other receivables 54,215 5,675

1,748,444 1,819,913

Allowance for expected credit loss (Note 14.1) (646,180) (615,483)

1,102,264 1,204,430

Other receivable in the current year consists mainly of $42,255,899 advanced to the builder

for the on-going construction of the investment properties, $10,000,000 yet to be paid on

one of the houses sold during the year and other receivables.

Trade receivables are non-interest bearing and are generally on terms of 30 to 90 days

except for receivables from government parastatals which are 300 days.

Set out below is the movement in the allowance for expected credit losses of trade and

other receivables:

Trade receivable

31-Mar-21 31-Mar-20

$’000 $’000

Gross 1,620,032 1,717,705

ECL (646,180) (615,483)

Net 973,852 1,102,222

14.1 Allowance for expected credit loss

Trade Receivable

At 1 April 615,483 481,807

Additional provision during the year (Note 5.8) 30,697 133,676

At 31 March 646,180 615,483

The significant changes in the balances of trade receivables are disclosed in Note 4.2 while

the information about the credit exposures are disclosed in Note 25.

89