Page 94 - Learn Africa 2021 Annual Report

P. 94

Learn Africa Plc

Notes to the Financial Statements (cont’d)

For the year ended 31 March 2021

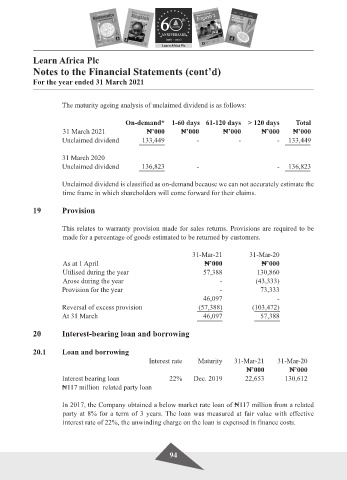

The maturity ageing analysis of unclaimed dividend is as follows:

On-demand* 1-60 days 61-120 days > 120 days Total

31 March 2021 $’000 $’000 $’000 $’000 $’000

Unclaimed dividend 133,449 - - - 133,449

31 March 2020

Unclaimed dividend 136,823 - - 136,823

Unclaimed dividend is classified as on-demand because we can not accurately estimate the

time frame in which shareholders will come forward for their claims.

19 Provision

This relates to warranty provision made for sales returns. Provisions are required to be

made for a percentage of goods estimated to be returned by customers.

31-Mar-21 31-Mar-20

As at 1 April $’000 $’000

Utilised during the year 57,388 130,860

Arose during the year - (43,333)

Provision for the year - 73,333

46,097 -

Reversal of excess provision (57,388) (103,472)

At 31 March 46,097 57,388

20 Interest-bearing loan and borrowing

20.1 Loan and borrowing

Interest rate Maturity 31-Mar-21 31-Mar-20

$’000 $’000

Interest bearing loan 22% Dec. 2019 22,653 130,612

$117 million related party loan

In 2017, the Company obtained a below market rate loan of $117 million from a related

party at 8% for a term of 3 years. The loan was measured at fair value with effective

interest rate of 22%, the unwinding charge on the loan is expensed in finance costs.

94