Page 17 - 1202 Question Bank Mathematics Form 5

P. 17

Section B

[45 marks]

Answer all questions in this section.

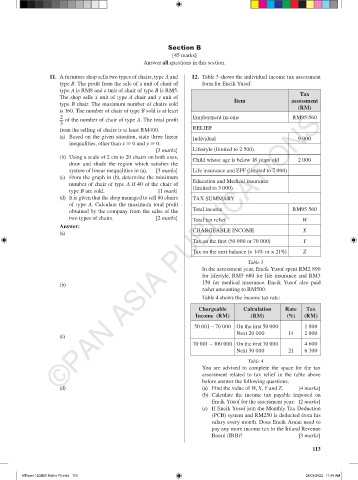

11. A furniture shop sells two types of chairs, type A and 12. Table 3 shows the individual income tax assessment

type B. The profit from the sale of a unit of chair of form for Encik Yusof.

type A is RM8 and a unit of chair of type B is RM5. Tax

The shop sells x unit of type A chair and y unit of Item assessment

type B chair. The maximum number of chairs sold (RM)

is 160. The number of chair of type B sold is at least

(d) ©PAN ASIA PUBLICATIONS

2 of the number of chair of type A. The total profit Employment income RM95 560

3

from the selling of chairs is at least RM400. RELIEF

(a) Based on the given situation, state three linear Individual 9 000

inequalities, other than x > 0 and y > 0.

[3 marks] Lifestyle (limited to 2 500)

(b) Using a scale of 2 cm to 20 chairs on both axes,

Child whose age is below 18 years old 2 000

draw and shade the region which satisfies the

system of linear inequalities in (a). [3 marks] Life insurance and EPF (limited to 7 000)

(c) From the graph in (b), determine the minimum

Education and Medical insurance

number of chair of type A if 40 of the chair of

(limited to 3 000)

type B are sold. [1 mark]

(d) It is given that the shop managed to sell 80 chairs TAX SUMMARY

of type A. Calculate the maximum total profit

obtained by the company from the sales of the Total income RM95 560

two types of chairs. [2 marks] Total tax relief W

Answer:

CHARGEABLE INCOME X

(a)

Tax on the first (50 000 or 70 000) Y

Tax on the next balance (× 14% or × 21%) Z

Table 3

In the assessment year, Encik Yusof spent RM2 890

for lifestyle, RM5 680 for life insurance and RM3

150 for medical insurance. Encik Yusof also paid

(b)

zakat amounting to RM500.

Table 4 shows the income tax rate:

Chargeable Calculation Rate Tax

Income (RM) (RM) (%) (RM)

50 001 – 70 000 On the first 50 000 1 800

Next 20 000 14 2 800

(c)

70 001 – 100 000 On the first 70 000 4 600

Next 30 000 21 6 300

Table 4

You are advised to complete the space for the tax

assessment related to tax relief in the table above

before answer the following questions.

(a) Find the value of W, X, Y and Z. [4 marks]

(b) Calculate the income tax payable imposed on

Encik Yusof for the assessment year. [2 marks]

(c) If Encik Yusof join the Monthly Tax Deduction

(PCB) system and RM250 is deducted from his

salary every month. Does Encik Aman need to

pay any more income tax to the Inland Revenue

Board (IRB)? [3 marks]

113

MPaper 1202BS Maths F5.indd 113 25/01/2022 11:49 AM