Page 12 - 2019 Social Security Cheat Sheet

P. 12

2019 REVISED EDITION:

Social Security Cheat Sheet

Collecting Benefits While Still Working

If you are planning to work and collect Social Security benefits, it is important to

know the 2019 earnings limit that applies both before and during the year you

reach Full Retirement Age (FRA). Prior to FRA, If you earn over $17,640 (up from

$17,040), $1 in benefits will be deducted for every $2 in earnings. During the year

you reach FRA, the limit increases to $46,920 (up from $45,360) and $1 in benefits

is deducted for every $3 in earnings. The amount is calculated monthly and based

on individual earnings, even if you are married filing jointly. Earnings after you turn

FRA (Age 66-67) do not count against you. Earned income only includes earnings

from your job and not additional income such as pension payments, retirement

account distributions or interest income. Social Security taxes, income taxes and

additional penalties may also apply in addition to any assessed work penalty.

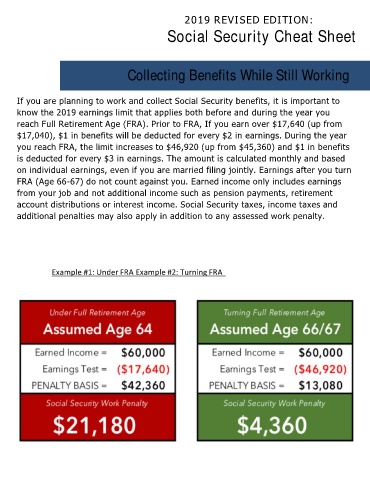

Example #1: Under FRA Example #2: Turning FRA