Page 13 - 2019 Social Security Cheat Sheet

P. 13

Income Taxes on Social Security Benefits

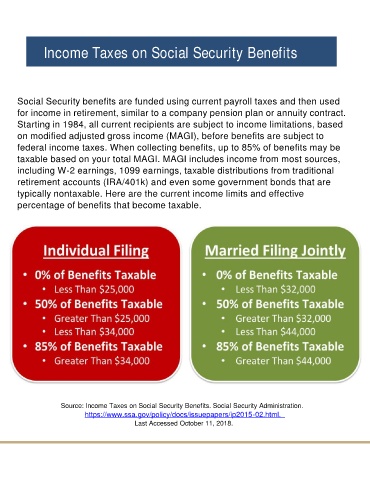

Social Security benefits are funded using current payroll taxes and then used

for income in retirement, similar to a company pension plan or annuity contract.

Starting in 1984, all current recipients are subject to income limitations, based

on modified adjusted gross income (MAGI), before benefits are subject to

federal income taxes. When collecting benefits, up to 85% of benefits may be

taxable based on your total MAGI. MAGI includes income from most sources,

including W-2 earnings, 1099 earnings, taxable distributions from traditional

retirement accounts (IRA/401k) and even some government bonds that are

typically nontaxable. Here are the current income limits and effective

percentage of benefits that become taxable.

Source: Income Taxes on Social Security Benefits. Social Security Administration.

https://www.ssa.gov/policy/docs/issuepapers/ip2015-02.html.

Last Accessed October 11, 2018.