Page 14 - 2019 Social Security Cheat Sheet

P. 14

2019 REVISED EDITION:

Social Security Cheat Sheet

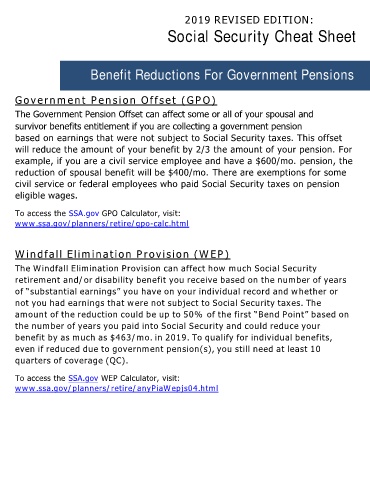

Benefit Reductions For Government Pensions

Government Pension Offset (GPO)

The Government Pension Offset can affect some or all of your spousal and

survivor benefits entitlement if you are collecting a government pension

based on earnings that were not subject to Social Security taxes. This offset

will reduce the amount of your benefit by 2/3 the amount of your pension. For

example, if you are a civil service employee and have a $600/mo. pension, the

reduction of spousal benefit will be $400/mo. There are exemptions for some

civil service or federal employees who paid Social Security taxes on pension

eligible wages.

To access the SSA.gov GPO Calculator, visit:

www.ssa.gov/planners/retire/gpo-calc.html

Windfall Elimination Provision (WEP)

The Windfall Elimination Provision can affect how much Social Security

retirement and/or disability benefit you receive based on the number of years

of “substantial earnings” you have on your individual record and whether or

not you had earnings that were not subject to Social Security taxes. The

amount of the reduction could be up to 50% of the first “Bend Point” based on

the number of years you paid into Social Security and could reduce your

benefit by as much as $463/mo. in 2019. To qualify for individual benefits,

even if reduced due to government pension(s), you still need at least 10

quarters of coverage (QC).

To access the SSA.gov WEP Calculator, visit:

www.ssa.gov/planners/retire/anyPiaWepjs04.html