Page 124 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 124

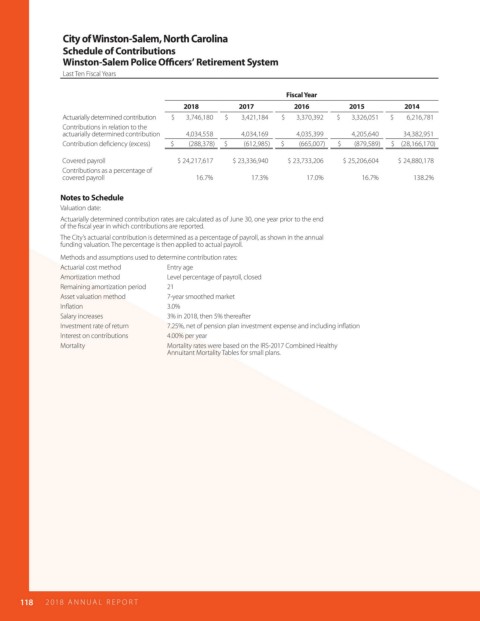

City of Winston-Salem, North Carolina

Schedule of Contributions

Winston-Salem Police O cers’ Retirement System

Last Ten Fiscal Years

Fiscal Year

2018 2017 2016 2015 2014

Actuarially determined contribution $ 3,746,180 $ 3,421,184 $ 3,370,392 $ 3,326,051 $ 6,216,781

Contributions in relation to the

actuarially determined contribution 4,034,558 4,034,169 4,035,399 4,205,640 34,382,951

Contribution de ciency (excess) $ (288,378) $ (612,985) $ (665,007) $ (879,589) $ (28,166,170)

Covered payroll $ 24,217,617 $ 23,336,940 $ 23,733,206 $ 25,206,604 $ 24,880,178

Contributions as a percentage of

covered payroll 16.7% 17.3% 17.0% 16.7% 138.2%

Notes to Schedule

Valuation date:

Actuarially determined contribution rates are calculated as of June 30, one year prior to the end

of the scal year in which contributions are reported.

The City’s actuarial contribution is determined as a percentage of payroll, as shown in the annual

funding valuation. The percentage is then applied to actual payroll.

Methods and assumptions used to determine contribution rates:

Actuarial cost method Entry age

Amortization method Level percentage of payroll, closed

Remaining amortization period 21

Asset valuation method 7-year smoothed market

In ation 3.0%

Salary increases 3% in 2018, then 5% thereafter

Investment rate of return 7.25%, net of pension plan investment expense and including in ation

Interest on contributions 4.00% per year

Mortality Mortality rates were based on the IRS-2017 Combined Healthy

Annuitant Mortality Tables for small plans.

118 2018 AN NUAL R E P O R T