Page 96 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 96

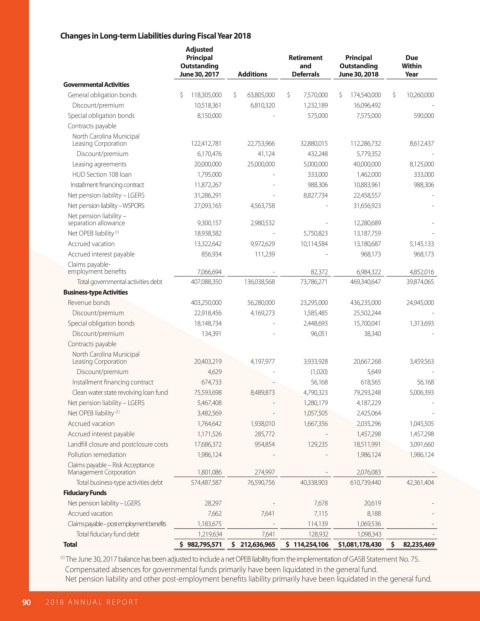

Changes in Long-term Liabilities during Fiscal Year 2018

Adjusted

Principal Retirement Principal Due

Outstanding and Outstanding Within

June 30, 2017 Additions Deferrals June 30, 2018 Year

Governmental Activities

General obligation bonds $ 118,305,000 $ 63,805,000 $ 7,570,000 $ 174,540,000 $ 10,260,000

Discount/premium 10,518,361 6,810,320 1,232,189 16,096,492 -

Special obligation bonds 8,150,000 - 575,000 7,575,000 590,000

Contracts payable

North Carolina Municipal

Leasing Corporation 122,412,781 22,753,966 32,880,015 112,286,732 8,612,437

Discount/premium 6,170,476 41,124 432,248 5,779,352 -

Leasing agreements 20,000,000 25,000,000 5,000,000 40,000,000 8,125,000

HUD Section 108 loan 1,795,000 - 333,000 1,462,000 333,000

Installment nancing contract 11,872,267 - 988,306 10,883,961 988,306

Net pension liability – LGERS 31,286,291 - 8,827,734 22,458,557 -

Net pension liability – WSPORS 27,093,165 4,563,758 - 31,656,923 -

Net pension liability –

separation allowance 9,300,157 2,980,532 - 12,280,689 -

Net OPEB liability (1) 18,938,582 - 5,750,823 13,187,759 -

Accrued vacation 13,322,642 9,972,629 10,114,584 13,180,687 5,145,133

Accrued interest payable 856,934 111,239 - 968,173 968,173

Claims payable-

employment bene ts 7,066,694 - 82,372 6,984,322 4,852,016

Total governmental activities debt 407,088,350 136,038,568 73,786,271 469,340,647 39,874,065

Business-type Activities

Revenue bonds 403,250,000 56,280,000 23,295,000 436,235,000 24,945,000

Discount/premium 22,918,456 4,169,273 1,585,485 25,502,244 -

Special obligation bonds 18,148,734 - 2,448,693 15,700,041 1,313,693

Discount/premium 134,391 - 96,051 38,340 -

Contracts payable

North Carolina Municipal

Leasing Corporation 20,403,219 4,197,977 3,933,928 20,667,268 3,459,563

Discount/premium 4,629 - (1,020) 5,649 -

Installment nancing contract 674,733 - 56,168 618,565 56,168

Clean water state revolving loan fund 75,593,698 8,489,873 4,790,323 79,293,248 5,006,393

Net pension liability – LGERS 5,467,408 - 1,280,179 4,187,229 -

Net OPEB liability (1) 3,482,569 - 1,057,505 2,425,064 -

Accrued vacation 1,764,642 1,938,010 1,667,356 2,035,296 1,045,505

Accrued interest payable 1,171,526 285,772 - 1,457,298 1,457,298

Land ll closure and postclosure costs 17,686,372 954,854 129,235 18,511,991 3,091,660

Pollution remediation 1,986,124 - - 1,986,124 1,986,124

Claims payable – Risk Acceptance

Management Corporation 1,801,086 274,997 - 2,076,083 -

Total business-type activities debt 574,487,587 76,590,756 40,338,903 610,739,440 42,361,404

Fiduciary Funds

Net pension liability – LGERS 28,297 - 7,678 20,619 -

Accrued vacation 7,662 7,641 7,115 8,188 -

Claims payable – post employment benefits 1,183,675 - 114,139 1,069,536 -

Total duciary fund debt 1,219,634 7,641 128,932 1,098,343 -

Total $ 982,795,571 $ 212,636,965 $ 114,254,106 $1,081,178,430 $ 82,235,469

(1) The June 30, 2017 balance has been adjusted to include a net OPEB liability from the implementation of GASB Statement No. 75.

Compensated absences for governmental funds primarily have been liquidated in the general fund.

Net pension liability and other post-employment bene ts liability primarily have been liquidated in the general fund.

90 2018 AN NUAL R E P O R T