Page 97 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 97

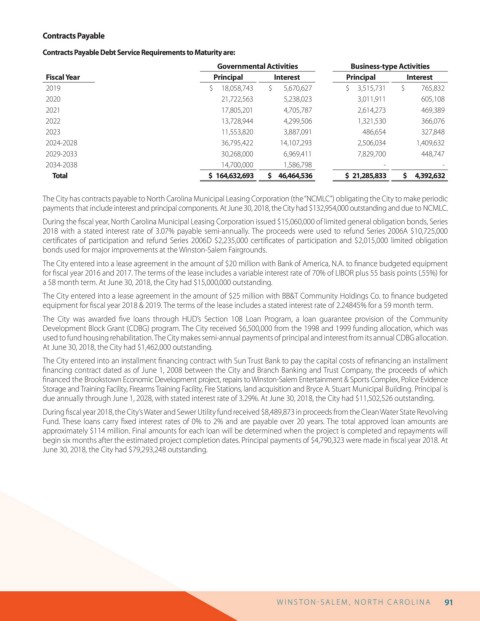

Contracts Payable

Contracts Payable Debt Service Requirements to Maturity are:

Governmental Activities Business-type Activities

Fiscal Year Principal Interest Principal Interest

2019 $ 18,058,743 $ 5,670,627 $ 3,515,731 $ 765,832

2020 21,722,563 5,238,023 3,011,911 605,108

2021 17,805,201 4,705,787 2,614,273 469,389

2022 13,728,944 4,299,506 1,321,530 366,076

2023 11,553,820 3,887,091 486,654 327,848

2024-2028 36,795,422 14,107,293 2,506,034 1,409,632

2029-2033 30,268,000 6,969,411 7,829,700 448,747

2034-2038 14,700,000 1,586,798 - -

Total $ 164,632,693 $ 46,464,536 $ 21,285,833 $ 4,392,632

The City has contracts payable to North Carolina Municipal Leasing Corporation (the “NCMLC”) obligating the City to make periodic

payments that include interest and principal components. At June 30, 2018, the City had $132,954,000 outstanding and due to NCMLC.

During the scal year, North Carolina Municipal Leasing Corporation issued $15,060,000 of limited general obligation bonds, Series

2018 with a stated interest rate of 3.07% payable semi-annually. The proceeds were used to refund Series 2006A $10,725,000

certi cates of participation and refund Series 2006D $2,235,000 certi cates of participation and $2,015,000 limited obligation

bonds used for major improvements at the Winston-Salem Fairgrounds.

The City entered into a lease agreement in the amount of $20 million with Bank of America, N.A. to nance budgeted equipment

for scal year 2016 and 2017. The terms of the lease includes a variable interest rate of 70% of LIBOR plus 55 basis points (.55%) for

a 58 month term. At June 30, 2018, the City had $15,000,000 outstanding.

The City entered into a lease agreement in the amount of $25 million with BB&T Community Holdings Co. to nance budgeted

equipment for scal year 2018 & 2019. The terms of the lease includes a stated interest rate of 2.24845% for a 59 month term.

The City was awarded ve loans through HUD’s Section 108 Loan Program, a loan guarantee provision of the Community

Development Block Grant (CDBG) program. The City received $6,500,000 from the 1998 and 1999 funding allocation, which was

used to fund housing rehabilitation. The City makes semi-annual payments of principal and interest from its annual CDBG allocation.

At June 30, 2018, the City had $1,462,000 outstanding.

The City entered into an installment nancing contract with Sun Trust Bank to pay the capital costs of re nancing an installment

nancing contract dated as of June 1, 2008 between the City and Branch Banking and Trust Company, the proceeds of which

nanced the Brookstown Economic Development project, repairs to Winston-Salem Entertainment & Sports Complex, Police Evidence

Storage and Training Facility, Firearms Training Facility, Fire Stations, land acquisition and Bryce A. Stuart Municipal Building. Principal is

due annually through June 1, 2028, with stated interest rate of 3.29%. At June 30, 2018, the City had $11,502,526 outstanding.

During scal year 2018, the City’s Water and Sewer Utility fund received $8,489,873 in proceeds from the Clean Water State Revolving

Fund. These loans carry xed interest rates of 0% to 2% and are payable over 20 years. The total approved loan amounts are

approximately $114 million. Final amounts for each loan will be determined when the project is completed and repayments will

begin six months after the estimated project completion dates. Principal payments of $4,790,323 were made in scal year 2018. At

June 30, 2018, the City had $79,293,248 outstanding.

W I N S T O N S AL E M , N O R T H C AR O L I N A 91