Page 94 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 94

As of June 30, 2018, the City was not exposed to credit risk because the swap had a negative fair value. Citigroup Global

Markets Holdings, Inc. has executed and delivered a Guarantor Agreement to the City, which “absolutely” and

“unconditionally” guarantees the payment to the City of any obligation of its wholly owned subsidiary, Citigroup, Inc. At

June 30, 2018, Citigroup Global Markets Holdings, Inc. was rated “Baa1” by Moody’s Investors Service, “BBB+” by Standard

& Poor’s Rating Services, and “A” by Fitch Ratings.

The derivative contract uses the International Swap Dealers Association Master Agreement, which includes standard

termination events, such as failure to pay and bankruptcy. Termination could result in the City being required to make or

being entitled to receive an unanticipated termination payment based upon the market value on the date of termination.

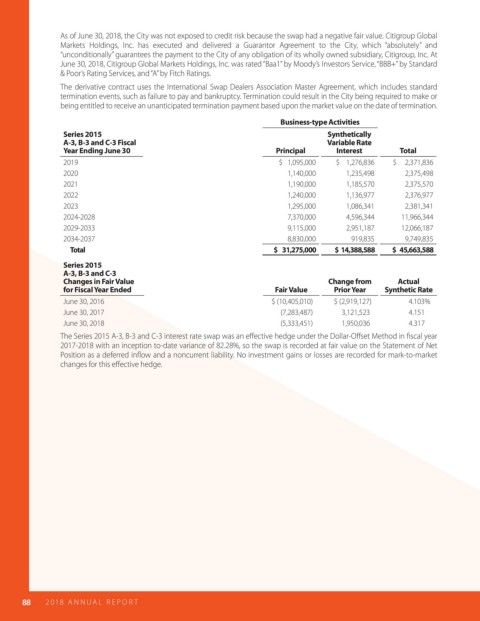

Business-type Activities

Series 2015 Synthetically

A-3, B-3 and C-3 Fiscal Variable Rate

Year Ending June 30 Principal Interest Total

2019 $ 1,095,000 $ 1,276,836 $ 2,371,836

2020 1,140,000 1,235,498 2,375,498

2021 1,190,000 1,185,570 2,375,570

2022 1,240,000 1,136,977 2,376,977

2023 1,295,000 1,086,341 2,381,341

2024-2028 7,370,000 4,596,344 11,966,344

2029-2033 9,115,000 2,951,187 12,066,187

2034-2037 8,830,000 919,835 9,749,835

Total $ 31,275,000 $ 14,388,588 $ 45,663,588

Series 2015

A-3, B-3 and C-3

Changes in Fair Value Change from Actual

for Fiscal Year Ended Fair Value Prior Year Synthetic Rate

June 30, 2016 $ (10,405,010) $ (2,919,127) 4.103%

June 30, 2017 (7,283,487) 3,121,523 4.151

June 30, 2018 (5,333,451) 1,950,036 4.317

The Series 2015 A-3, B-3 and C-3 interest rate swap was an e ective hedge under the Dollar-O set Method in scal year

2017-2018 with an inception to-date variance of 82.28%, so the swap is recorded at fair value on the Statement of Net

Position as a deferred in ow and a noncurrent liability. No investment gains or losses are recorded for mark-to-market

changes for this e ective hedge.

88 2018 AN NUAL R E P O R T