Page 93 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 93

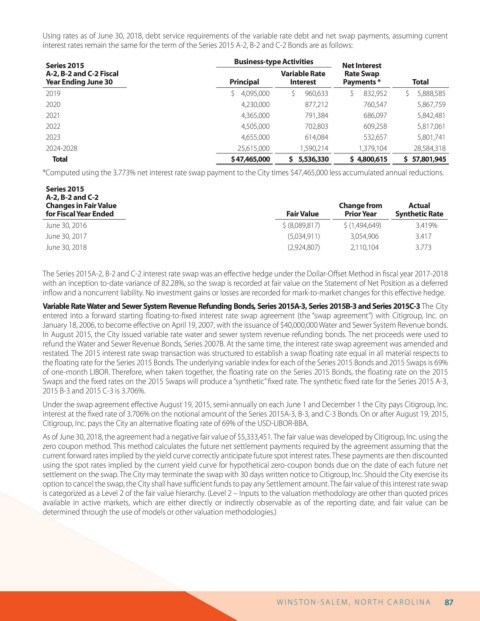

Using rates as of June 30, 2018, debt service requirements of the variable rate debt and net swap payments, assuming current

interest rates remain the same for the term of the Series 2015 A-2, B-2 and C-2 Bonds are as follows:

Series 2015 Business-type Activities Net Interest

A-2, B-2 and C-2 Fiscal Variable Rate Rate Swap

Year Ending June 30 Principal Interest Payments * Total

2019 $ 4,095,000 $ 960,633 $ 832,952 $ 5,888,585

2020 4,230,000 877,212 760,547 5,867,759

2021 4,365,000 791,384 686,097 5,842,481

2022 4,505,000 702,803 609,258 5,817,061

2023 4,655,000 614,084 532,657 5,801,741

2024-2028 25,615,000 1,590,214 1,379,104 28,584,318

Total $ 47,465,000 $ 5,536,330 $ 4,800,615 $ 57,801,945

*Computed using the 3.773% net interest rate swap payment to the City times $47,465,000 less accumulated annual reductions.

Series 2015

A-2, B-2 and C-2

Changes in Fair Value Change from Actual

for Fiscal Year Ended Fair Value Prior Year Synthetic Rate

June 30, 2016 $ (8,089,817) $ (1,494,649) 3.419%

June 30, 2017 (5,034,911) 3,054,906 3.417

June 30, 2018 (2,924,807) 2,110,104 3.773

The Series 2015A-2, B-2 and C-2 interest rate swap was an e ective hedge under the Dollar-O set Method in scal year 2017-2018

with an inception to-date variance of 82.28%, so the swap is recorded at fair value on the Statement of Net Position as a deferred

in ow and a noncurrent liability. No investment gains or losses are recorded for mark-to-market changes for this e ective hedge.

Variable Rate Water and Sewer System Revenue Refunding Bonds, Series 2015A-3, Series 2015B-3 and Series 2015C-3 The City

entered into a forward starting oating-to- xed interest rate swap agreement (the “swap agreement”) with Citigroup, Inc. on

January 18, 2006, to become e ective on April 19, 2007, with the issuance of $40,000,000 Water and Sewer System Revenue bonds.

In August 2015, the City issued variable rate water and sewer system revenue refunding bonds. The net proceeds were used to

refund the Water and Sewer Revenue Bonds, Series 2007B. At the same time, the interest rate swap agreement was amended and

restated. The 2015 interest rate swap transaction was structured to establish a swap oating rate equal in all material respects to

the oating rate for the Series 2015 Bonds. The underlying variable index for each of the Series 2015 Bonds and 2015 Swaps is 69%

of one-month LIBOR. Therefore, when taken together, the oating rate on the Series 2015 Bonds, the oating rate on the 2015

Swaps and the xed rates on the 2015 Swaps will produce a “synthetic” xed rate. The synthetic xed rate for the Series 2015 A-3,

2015 B-3 and 2015 C-3 is 3.706%.

Under the swap agreement e ective August 19, 2015, semi-annually on each June 1 and December 1 the City pays Citigroup, Inc.

interest at the xed rate of 3.706% on the notional amount of the Series 2015A-3, B-3, and C-3 Bonds. On or after August 19, 2015,

Citigroup, Inc. pays the City an alternative oating rate of 69% of the USD-LIBOR-BBA.

As of June 30, 2018, the agreement had a negative fair value of $5,333,451. The fair value was developed by Citigroup, Inc. using the

zero coupon method. This method calculates the future net settlement payments required by the agreement assuming that the

current forward rates implied by the yield curve correctly anticipate future spot interest rates. These payments are then discounted

using the spot rates implied by the current yield curve for hypothetical zero-coupon bonds due on the date of each future net

settlement on the swap. The City may terminate the swap with 30 days written notice to Citigroup, Inc. Should the City exercise its

option to cancel the swap, the City shall have su cient funds to pay any Settlement amount. The fair value of this interest rate swap

is categorized as a Level 2 of the fair value hierarchy. (Level 2 – Inputs to the valuation methodology are other than quoted prices

available in active markets, which are either directly or indirectly observable as of the reporting date, and fair value can be

determined through the use of models or other valuation methodologies.)

W I N S T O N S AL E M , N O R T H C AR O L I N A 87