Page 50 - NEDBANK YES BOOKLET

P. 50

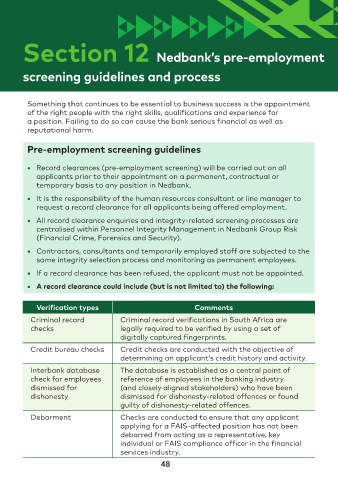

Section 12 Nedbank’s pre-employment

screening guidelines and process

Something that continues to be essential to business success is the appointment

of the right people with the right skills, qualifications and experience for

a position. Failing to do so can cause the bank serious financial as well as

reputational harm.

Pre-employment screening guidelines

• Record clearances (pre-employment screening) will be carried out on all

applicants prior to their appointment on a permanent, contractual or

temporary basis to any position in Nedbank.

• It is the responsibility of the human resources consultant or line manager to

request a record clearance for all applicants being offered employment.

• All record clearance enquiries and integrity-related screening processes are

centralised within Personnel Integrity Management in Nedbank Group Risk

(Financial Crime, Forensics and Security).

• Contractors, consultants and temporarily employed staff are subjected to the

same integrity selection process and monitoring as permanent employees.

• If a record clearance has been refused, the applicant must not be appointed.

• A record clearance could include (but is not limited to) the following:

Verification types Comments

Criminal record Criminal record verifications in South Africa are

checks legally required to be verified by using a set of

digitally captured fingerprints.

Credit bureau checks Credit checks are conducted with the objective of

determining an applicant’s credit history and activity.

Interbank database The database is established as a central point of

check for employees reference of employees in the banking industry

dismissed for (and closely aligned stakeholders) who have been

dishonesty dismissed for dishonesty-related offences or found

guilty of dishonesty-related offences.

Debarment Checks are conducted to ensure that any applicant

applying for a FAIS-affected position has not been

debarred from acting as a representative, key

individual or FAIS compliance officer in the financial

services industry.

48