Page 38 - 2020 Benefits Guide

P. 38

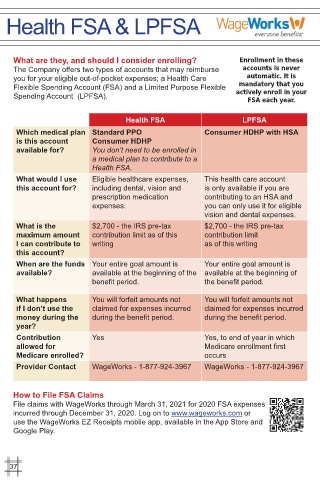

Health FSA & LPFSA

What are they, and should I consider enrolling? Enrollment in these

The Company offers two types of accounts that may reimburse accounts is never

you for your eligible out-of-pocket expenses; a Health Care automatic. It is

Flexible Spending Account (FSA) and a Limited Purpose Flexible mandatory that you

Spending Account (LPFSA). actively enroll in your

FSA each year.

Health FSA LPFSA

Which medical plan Standard PPO Consumer HDHP with HSA

is this account Consumer HDHP

available for? You don’t need to be enrolled in

a medical plan to contribute to a

Health FSA.

What would I use Eligible healthcare expenses, This health care account

this account for? including dental, vision and is only available if you are

prescription medication contributing to an HSA and

expenses. you can only use it for eligible

vision and dental expenses.

What is the $2,700 - the IRS pre-tax $2,700 - the IRS pre-tax

maximum amount contribution limit as of this contribution limit

I can contribute to writing as of this writing

this account?

When are the funds Your entire goal amount is Your entire goal amount is

available? available at the beginning of the available at the beginning of

benefit period. the benefit period.

What happens You will forfeit amounts not You will forfeit amounts not

if I don’t use the claimed for expenses incurred claimed for expenses incurred

money during the during the benefit period. during the benefit period.

year?

Contribution Yes Yes, to end of year in which

allowed for Medicare enrollment first

Medicare enrolled? occurs

Provider Contact WageWorks - 1-877-924-3967 WageWorks - 1-877-924-3967

How to File FSA Claims

File claims with WageWorks through March 31, 2021 for 2020 FSA expenses

incurred through December 31, 2020. Log on to www.wageworks.com or

use the WageWorks EZ Receipts mobile app, available in the App Store and

Google Play.

37