Page 37 - 2020 Benefits Guide

P. 37

What happens to those you love if something

happens to you?

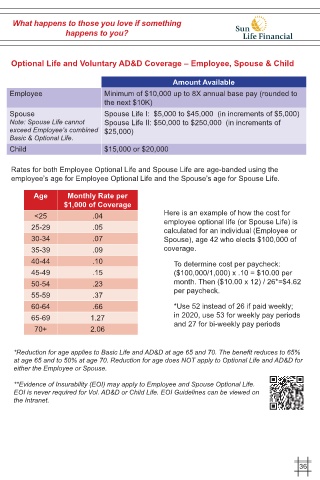

Optional Life and Voluntary AD&D Coverage – Employee, Spouse & Child

Amount Available

Employee Minimum of $10,000 up to 8X annual base pay (rounded to

the next $10K)

Spouse Spouse Life I: $5,000 to $45,000 (in increments of $5,000)

Note: Spouse Life cannot Spouse Life II: $50,000 to $250,000 (in increments of

exceed Employee’s combined $25,000)

Basic & Optional Life.

Child $15,000 or $20,000

Rates for both Employee Optional Life and Spouse Life are age-banded using the

employee’s age for Employee Optional Life and the Spouse’s age for Spouse Life.

Age Monthly Rate per

$1,000 of Coverage

<25 .04 Here is an example of how the cost for

25-29 .05 employee optional life (or Spouse Life) is

calculated for an individual (Employee or

30-34 .07 Spouse), age 42 who elects $100,000 of

35-39 .09 coverage.

40-44 .10 To determine cost per paycheck:

45-49 .15 ($100,000/1,000) x .10 = $10.00 per

50-54 .23 month. Then ($10.00 x 12) / 26*=$4.62

55-59 .37 per paycheck.

60-64 .66 *Use 52 instead of 26 if paid weekly;

65-69 1.27 in 2020, use 53 for weekly pay periods

70+ 2.06 and 27 for bi-weekly pay periods

*Reduction for age applies to Basic Life and AD&D at age 65 and 70. The benefit reduces to 65%

at age 65 and to 50% at age 70. Reduction for age does NOT apply to Optional Life and AD&D for

either the Employee or Spouse.

**Evidence of Insurability (EOI) may apply to Employee and Spouse Optional Life.

EOI is never required for Vol. AD&D or Child Life. EOI Guidelines can be viewed on

the Intranet.

36