Page 36 - 2021 Team Member Benefit Guide - English

P. 36

Short Term Disability

The Short-Term Disability (STD) Plan is a voluntary, self-insured plan you can elect to provide

income protection for non-work related illness or injury. The plan is designed to provide income

protection for disability absences greater than 14 days, but no longer than 13 weeks in duration.

You pay the full cost for coverage and you must enroll in the plan to receive the benefit.

Employees who live or work in the states of California, New Jersey, New York and Washington

are enrolled automatically in the applicable state-mandated short-term disability and, where

applicable, paid family leave programs.

Benefits under the Voluntary Short Term Disability plan will be reduced by benefits paid

under any state Short Term Disability program in California, New Jersey, New York and

Washington (where such plans are required). Employees in these states should consider

whether the election of the Voluntary Short-Term Disability is beneficial.

Our voluntary Short-Term Disability benefits are payable for non-work related illness or injury

after 14 consecutive days of disability. If your absence is expected to be 14 days or less, you

will not have a benefit payable under this plan. The plan begins payments on the 15th day

following your date of disability. The plan will pay you 70 percent of your base rate of pay for up

to 11 weeks, as long as your disability is properly substantiated by your treating physician.

Once Sun Life has approved your claim, they will notify you and the Company. Your STD benefit

will be paid to you by the Company on the next scheduled payroll run. Your usual deductions

will be withheld from your STD benefit payment.

If you do not enroll in the STD plan when you are first eligible, you may enroll during the next annual

enrollment. Evidence of Insurability (EOI) is not required to enroll in the STD plan.

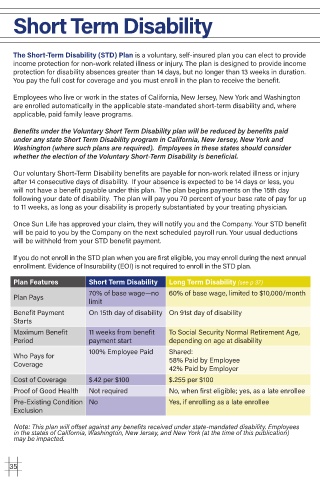

Plan Features Short Term Disability Long Term Disability (see p 37)

70% of base wage—no 60% of base wage, limited to $10,000/month

Plan Pays limit

Benefit Payment On 15th day of disability On 91st day of disability

Starts

Maximum Benefit 11 weeks from benefit To Social Security Normal Retirement Age,

Period payment start depending on age at disability

100% Employee Paid Shared:

Who Pays for 58% Paid by Employee

Coverage

42% Paid by Employer

Cost of Coverage $.42 per $100 $.255 per $100

Proof of Good Health Not required No, when first eligible; yes, as a late enrollee

Pre-Existing Condition No Yes, if enrolling as a late enrollee

Exclusion

Note: This plan will offset against any benefits received under state-mandated disability. Employees

in the states of California, Washington, New Jersey, and New York (at the time of this publication)

may be impacted.

35