Page 38 - 2021 Team Member Benefit Guide - English

P. 38

Long Term Disability

The Long-Term Disability (LTD) Plan is a months. A pre-existing condition is a

fully-insured plan offered through Sun Life. sickness or injury for which you, during

Enrollment in the LTD plan is voluntary. the three months prior to your coverage

The plan is designed to provide income effective date, received medical treatment,

protection to you during times of extended consultation, care or services; took

illness or injury over several months or even prescription medication or had medications

years, depending on your age at the onset prescribed.

of disability. If you are receiving benefit

payments under the STD plan and become The plan imposes a 24-month benefit

eligible for LTD, your claim will automatically duration limit for certain illnesses such

transition to Sun Life’s LTD claims unit. LTD as mental/nervous conditions, chemical

payments will be paid to you directly by Sun dependency, chronic fatigue and

Life, beginning on the 91st day of disability. fibromyalgia.

You can see more ways to compare LTD and

STD on p. 31. Cost of Coverage

The Company shares the cost of LTD

Plan Benefit coverage with you. In the event of your

Benefits are payable for illness or injury disability, the portion of the benefit you

after 90 continuous days of disability with receive under the plan attributable to your

benefit payments to begin on your 91st day of share of the cost of coverage is not taxable

disability. The plan will pay 60 percent of your to you. The portion of your benefit payment

base rate of pay in effect prior to your date of attributable to the shared cost paid by the

disability up to a limit of $10,000 per month. Company is taxable to you.

Your monthly benefit under the plan will be

offset for other household income, such as Calculate your cost for Long-Term

social security or worker’s compensation Disability

earnings. Your premium is determined by your base

rate of pay. These premiums are withheld

Plan Limitations and Exclusions on an after-tax basis. When using Dayforce

The plan does not cover disability due to a enrollment, your cost for coverage will

pre-existing condition until you have been automatically populate. The formula used to

covered under the plan for 12 consecutive calculate your premium is below..

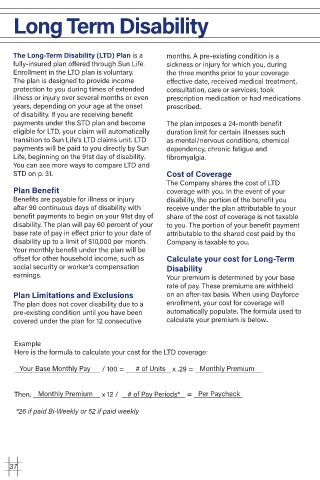

Example

Here is the formula to calculate your cost for the LTD coverage:

Your Base Monthly Pay

# of Units

_______________________ / 100 = ____________ x .29 = __________________

Monthly Premium

Per Paycheck

Monthly Premium

# of Pay Periods*

Then, __________________ x 12 / _________________ = _____________

*26 if paid Bi-Weekly or 52 if paid weekly

37