Page 22 - Hybrid PBD 2022 Form 5 - Mathematics

P. 22

Matematik Tingkatan 5 Bab 3 Matematik Pengguna: Insurans

(b) (i) Encik Tan membeli polisi insurans dengan (c) (i) Sarah membeli polisi insurans dengan

nilai muka RM200 000. Encik Tan ialah nilai muka RM80 000. Sarah ialah seorang

seorang lelaki perokok yang berusia 50 perempuan bukan perokok yang berusia 31

tahun. tahun.

Mr Tan buys an insurance policy with face value of Sarah buys an insurance policy with face value of

RM200 000. Mr Tan is a man at the age of 50 years old RM80 000. Sarah is a woman at the age of 31 years old

and is a smoker. and is a non-smoker.

200 000 80 000

Premium = × 5.22 = RM1 044 Premium = × 1.59 = RM127.20

1 000 1 000

(ii) Encik Tan ingin mendapatkan perlindungan (ii) Sarah ingin mendapatkan perlindungan

tambahan bagi penyakit kritikal dengan tambahan bagi penyakit kritikal dengan

perlindungan sebanyak 20% nilai muka asas perlindungan sebanyak 30% nilai muka asas

Penerbitan Pelangi Sdn Bhd. All Rights Reserved

dan kadar premium ialah RM3.18 setiap dan kadar premium ialah RM1.98 setiap

RM1 000. RM1 000.

Mr Tan would like to have an additional coverage Sarah would like to have an additional coverage for

for critical illness of 20% of basic face value and the critical illness of 30% of basic face value and the premium

premium rate is RM3.18 per RM1 000. rate is RM1.98 per RM1 000.

20 30

× 200 000 = RM40 000 × 80 000 = RM24 000

100 100

40 000 24 000

Premium = 1 044 + × 3.18 Premium = 127.20 + × 1.98

1 000 1 000

= 1 044 + 127.20 = 127.20 + 47.52

= RM1 171.20 = RM174.72

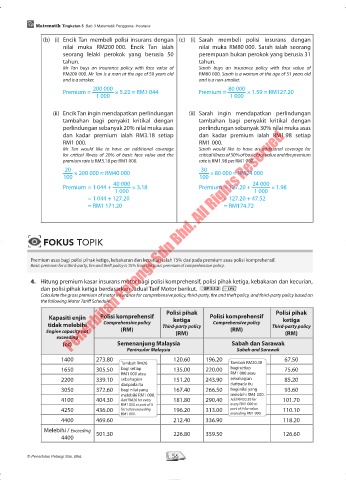

FOKUS TOPIK

Premium asas bagi polisi pihak ketiga, kebakaran dan kecurian ialah 75% daripada premium asas polisi komprehensif.

Basic premium for a third-party, fire and theft policy is 75% from the basic premium of comprehensive policy.

4. Hitung premium kasar insurans motor bagi polisi komprehensif, polisi pihak ketiga, kebakaran dan kecurian,

dan polisi pihak ketiga berdasarkan Jadual Tarif Motor berikut. SP 3.1.2 TP5

Calculate the gross premium of motor insurance for comprehensive policy, third-party, fire and theft policy, and third-party policy based on

the following Motor Tariff Schedule.

Polisi pihak Polisi pihak

Kapasiti enjin Polisi komprehensif ketiga Polisi komprehensif ketiga

tidak melebihi Comprehensive policy Third-party policy Comprehensive policy Third-party policy

Engine capacity not (RM) (RM) (RM) (RM)

exceeding

(cc) Semenanjung Malaysia Sabah dan Sarawak

Peninsular Malaysia Sabah and Sarawak

1400 273.80 120.60 196.20 67.50

Tambah RM26 Tambah RM20.30

1650 305.50 bagi setiap 135.00 220.00 bagi setiap 75.60

RM1 000 atau RM1 000 atau

2200 339.10 sebahagian 151.20 243.90 sebahagian 85.20

daripada itu daripada itu

3050 372.60 bagi nilai yang 167.40 266.50 bagi nilai yang 93.60

melebihi RM1 000. melebihi RM1 000.

4100 404.30 Add RM26 for every 181.80 290.40 Add RM20.30 for 101.70

RM1 000 or part of it every RM1 000 or

4250 436.00 for value exceeding 196.20 313.00 part of it for value 110.10

RM1 000. exceeding RM1 000.

4400 469.60 212.40 336.90 118.20

Melebihi / Exceeding 501.30 226.80 359.50 126.60

4400

© Penerbitan Pelangi Sdn. Bhd. 56

03 Hybrid PBD Mate Tg5.indd 56 28/09/2021 5:08 PM