Page 85 - mutual-fund-insight - Mar 2021_Neat

P. 85

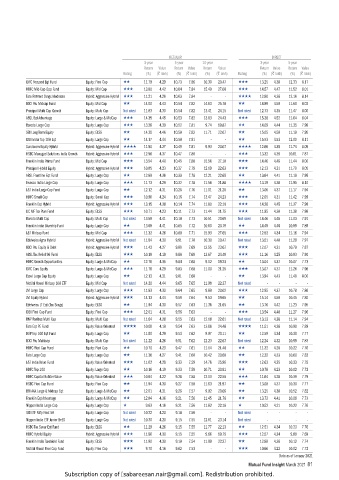

REGULAR DIRECT

3-year 5-year 10-year 3-year 5-year

Return Value Return Value Return Value Return Value Return Value

Rating (%) (` lakh) (%) (` lakh) (%) (` lakh) Rating (%) (` lakh) (%) (` lakh)

IDFC Focused Eqt Fund Equity: Flexi Cap 11.79 4.29 10.73 7.86 10.30 20.47 13.25 4.38 12.33 8.17

HDFC Mid-Cap Opp Fund Equity: Mid Cap 13.80 4.42 10.64 7.84 15.49 27.00 14.57 4.47 11.52 8.01

Tata Retrmnt Svngs Moderate Hybrid: Aggressive Hybrid 11.21 4.26 10.63 7.84 - - 12.80 4.36 12.16 8.14

ICICI Pru Midcap Fund Equity: Mid Cap 14.00 4.43 10.54 7.82 14.63 25.78 14.99 4.50 11.60 8.03

Principal Multi Cap Growth Equity: Multi Cap Not rated 11.83 4.30 10.54 7.82 13.41 24.15 Not rated 12.73 4.35 11.47 8.00

ABSL Eqt Advantage Equity: Large & MidCap 14.35 4.45 10.53 7.82 13.63 24.43 15.38 4.52 11.64 8.04

Baroda Large Cap Equity: Large Cap 13.28 4.39 10.52 7.81 9.74 19.87 14.09 4.44 11.35 7.98

SBI Long Term Equity Equity: ELSS 14.38 4.46 10.50 7.82 11.71 22.07 15.05 4.50 11.19 7.95

IDBI India Top 100 Eqt Equity: Large Cap 14.17 4.44 10.50 7.81 - - 15.53 4.53 12.00 8.11

Sundaram Equity Hybrid Hybrid: Aggressive Hybrid 11.50 4.27 10.49 7.81 9.93 20.07 12.66 4.35 11.74 8.05

HSBC Managed Solutions India Growth Hybrid: Aggressive Hybrid 12.96 4.37 10.47 7.80 - - 13.32 4.39 10.81 7.87

Franklin India Prima Fund Equity: Mid Cap 13.54 4.40 10.45 7.80 15.56 27.10 14.46 4.46 11.44 8.00

Principal Hybrid Equity Hybrid: Aggressive Hybrid 10.85 4.23 10.37 7.79 12.19 22.63 12.13 4.31 11.70 8.05

ABSL Frontline Eqt Fund Equity: Large Cap 12.89 4.36 10.33 7.78 12.21 22.65 13.64 4.41 11.19 7.95

Invesco India Large Cap Equity: Large Cap 11.73 4.29 10.32 7.78 11.56 21.88 13.19 4.38 11.95 8.10

L&T India Large Cap Fund Equity: Large Cap 12.12 4.31 10.26 7.76 11.01 21.26 13.06 4.37 11.17 7.94

HDFC Small Cap Equity: Small Cap 10.96 4.24 10.16 7.74 13.47 24.23 12.05 4.31 11.42 7.99

Franklin Eqt Hybrid Hybrid: Aggressive Hybrid 13.15 4.38 10.14 7.74 11.80 22.16 14.28 4.45 11.37 7.98

LIC MF Tax Plan Fund Equity: ELSS 10.71 4.23 10.11 7.73 11.44 21.75 11.95 4.30 11.38 7.98

Baroda Multi Cap Equity: Multi Cap Not rated 13.59 4.41 10.10 7.73 10.51 20.69 Not rated 14.46 4.46 11.03 7.91

Franklin India Bluechip Fund Equity: Large Cap 13.68 4.41 10.05 7.72 10.60 20.79 14.49 4.46 10.89 7.89

L&T Midcap Fund Equity: Mid Cap 11.32 4.26 10.00 7.71 15.93 27.65 12.53 4.34 11.16 7.94

Edelweiss Agrsv Hybrid Hybrid: Aggressive Hybrid Not rated 11.84 4.30 9.91 7.70 10.30 20.47 Not rated 13.51 4.40 11.29 7.97

ICICI Pru Equity & Debt Hybrid: Aggressive Hybrid 11.43 4.27 9.89 7.69 12.55 23.07 12.07 4.31 10.79 7.87

ABSL Tax Relief 96 Fund Equity: ELSS 10.18 4.19 9.86 7.69 13.67 24.49 11.16 4.25 10.93 7.90

HDFC Growth Opportunities Equity: Large & MidCap 12.76 4.35 9.84 7.68 9.12 19.23 13.04 4.37 10.07 7.73

IDFC Core Equity Equity: Large & MidCap 11.78 4.29 9.83 7.68 11.00 21.25 13.07 4.37 11.26 7.96

Essel Large Cap Equity Equity: Large Cap 12.13 4.31 9.81 7.68 - - 13.94 4.43 11.48 8.00

Motilal Oswal Midcap 100 ETF Equity: Mid Cap Not rated 14.20 4.44 9.65 7.65 11.98 22.37 Not rated - - - -

JM Large Cap Equity: Large Cap 11.83 4.30 9.64 7.65 9.89 20.02 12.95 4.37 10.78 7.86

JM Equity Hybrid Hybrid: Aggressive Hybrid 14.13 4.44 9.59 7.64 9.53 19.65 15.14 4.50 10.45 7.80

Edelweiss LT Eqt (Tax Svngs) Equity: ELSS 11.94 4.30 9.57 7.63 11.36 21.65 13.76 4.42 11.23 7.95

IDBI Flexi Cap Fund Equity: Flexi Cap 12.01 4.31 9.56 7.63 - - 13.54 4.40 11.27 7.96

BNP Paribas Multi Cap Equity: Multi Cap Not rated 11.64 4.28 9.55 7.63 12.18 22.61 Not rated 13.13 4.38 11.14 7.94

Tata Eqt PE Fund Equity: Value Oriented 10.08 4.19 9.54 7.63 13.66 24.48 11.51 4.28 10.90 7.89

DSP Top 100 Eqt Fund Equity: Large Cap 11.80 4.29 9.53 7.62 9.97 20.11 12.59 4.34 10.30 7.77

ICICI Pru Multicap Equity: Multi Cap Not rated 11.22 4.26 9.51 7.62 12.23 22.67 Not rated 12.24 4.32 10.59 7.83

HDFC Flexi Cap Fund Equity: Flexi Cap 10.70 4.23 9.47 7.61 11.14 21.40 11.32 4.26 10.22 7.76

Tata Large Cap Equity: Large Cap 11.36 4.27 9.41 7.60 10.42 20.60 12.32 4.33 10.60 7.83

L&T India Value Fund Equity: Value Oriented 11.62 4.28 9.33 7.59 14.76 25.96 12.63 4.35 10.33 7.78

HDFC Top 100 Equity: Large Cap 10.16 4.19 9.33 7.59 10.71 20.91 10.78 4.23 10.02 7.72

HDFC Capital Builder Value Equity: Value Oriented 10.64 4.22 9.28 7.58 12.13 22.56 11.64 4.28 10.39 7.79

HSBC Flexi Cap Fund Equity: Flexi Cap 11.94 4.30 9.27 7.58 11.63 21.97 13.08 4.37 10.30 7.77

BOI AXA Large & Midcap Eqt Equity: Large & MidCap 12.01 4.31 9.26 7.57 9.92 20.06 13.25 4.38 10.52 7.82

Franklin Eqt Advantage Equity: Large & MidCap 12.84 4.36 9.21 7.56 11.45 21.76 13.73 4.41 10.08 7.73

Nippon India Large Cap Equity: Large Cap 9.63 4.16 9.21 7.56 11.82 22.18 10.52 4.21 10.22 7.76

SBI ETF Nifty Next 50 Equity: Large Cap Not rated 10.22 4.20 9.18 7.56 - - Not rated - - - -

Nippon India ETF Junior BeES Equity: Large Cap Not rated 10.30 4.20 9.15 7.55 12.61 23.14 Not rated - - - -

HSBC Tax Saver Eqt Fund Equity: ELSS 11.29 4.26 9.15 7.55 11.77 22.13 12.51 4.34 10.23 7.76

HDFC Hybrid Equity Hybrid: Aggressive Hybrid 11.86 4.30 9.15 7.55 9.66 19.79 12.57 4.34 9.89 7.69

Franklin India Taxshield Fund Equity: ELSS 11.90 4.30 9.10 7.54 11.89 22.27 12.88 4.36 10.12 7.74

Motilal Oswal Flexi Cap Fund Equity: Flexi Cap 9.70 4.16 9.02 7.53 - - 10.66 4.22 10.02 7.72

Data as of January 2021

Mutual Fund Insight March 2021 81

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.