Page 80 - mutual-fund-insight - Mar 2021_Neat

P. 80

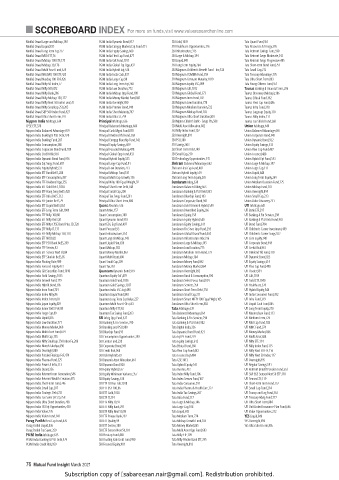

SCOREBOARD INDEX For more on funds, visit www.valueresearchonline.com

Motilal Oswal Large and Midcap,140 PGIM India Dynamic Bond,917 SBI Gold,1039 Tata Quant Fund,361

Motilal Oswal Liquid,833 PGIM India Emrgng Markets Eqt Fund,431 SBI Healthcare Opportunities,326 Tata Resources & Energy,376

Motilal Oswal Long Term Eqt,257 PGIM India Equity Savings,608 SBI Infrastructure,315 Tata Retrmnt Savings Cons,590

Motilal Oswal M50 ETF,76 PGIM India Flexi Cap Fund,477 SBI Large & Midcap,144 Tata Retrmnt Svngs Moderate,542

Motilal Oswal Midcap 100 ETF,175 PGIM India Gilt Fund,1011 SBI Liquid,841 Tata Retrmnt Svngs Progressive,485

Motilal Oswal Midcap 30,176 PGIM India Global Eqt Opp,432 SBI Long Term Equity,264 Tata Short-term Bond Fund,751

Motilal Oswal Multi Asset Fund,678 PGIM India Hybrid Eqt,534 SBI Magnum Children’s Benefit Fund - Inv,538 Tata Small Cap,212

Motilal Oswal NASDAQ 100 ETF,425 PGIM India Insta Cash,837 SBI Magnum COMMA Fund,358 Tata Treasury Advantage,776

Motilal Oswal Nasdaq 100 FOF,426 PGIM India Large Cap,90 SBI Magnum Constant Maturity,1019 Tata Ultra Short Term,803

Motilal Oswal Nifty 50 Index,77 PGIM India Long Term Eqt,260 SBI Magnum Equity ESG,499 Tata Young Citizens Fund,551

Motilal Oswal Nifty 500,472 PGIM India Low Duration,772 SBI Magnum Gilt,1012 Taurus Banking & Financial Srvcs,296

Motilal Oswal Nifty Bank,286 PGIM India Midcap Opp Fund,180 SBI Magnum Global Fund,373 Taurus Discovery (Midcap),186

Motilal Oswal Nifty Midcap 150,177 PGIM India Money Market Fund,861 SBI Magnum Incm Fund,702 Taurus Ethical Fund,362

Motilal Oswal Nifty Next 50 Index Fund,78 PGIM India Overnight,890 SBI Magnum Low Duration,774 Taurus Flexi Cap Fund,486

Motilal Oswal Nifty Smallcap 250,205 PGIM India Premier Bond,940 SBI Magnum Medium Duration,722 Taurus Infra Fund,318

Motilal Oswal S&P 500 Index Fund,427 PGIM India Short Maturity,747 SBI Magnum Midcap Fund,183 Taurus Largecap Equity,110

Motilal Oswal Ultra Short Term,797 PGIM India Ultra ST,799 SBI Magnum Ultra Short Duration,801 Taurus Nifty Index,111

Nippon India Arbitrage,634 Principal Arbitrage,636 SBI Mgnm Chldrn’s Bnfit - Svngs Pln,588 Taurus Tax Shield Fund,268

CPSE ETF,378 Principal Balanced Advantage,660 SBI Multi Asset Allocation,682 Union Arbitrage,640

Nippon India Balanced Advantage,659 Principal Cash Mgmt Fund,838 SBI Nifty Index Fund,102 Union Balanced Advantage,665

Nippon India Banking & PSU Debt,978 Principal Dividend Yld Fund,368 SBI Overnight,891 Union Corporate Bond,943

Nippon India Banking Fund,287 Principal Emrgng Bluechip Fund,142 SBI PSU,380 Union Dynamic Bond,922

Nippon India Consumption,386 Principal Equity Savings,609 SBI Savings,863 Union Equity Savings,613

Nippon India Corporate Bond Fund,939 Principal Focused Multicap,478 SBI Short Term Debt,749 Union Flexi Cap Fund,487

Nippon India Credit Risk,958 Principal Global Opp Fund,433 SBI Small Cap,210 Union Focused,488

Nippon India Dynamic Bond Fund,916 Principal Hybrid Equity,535 SBI Technology Opportunities,335 Union Hybrid Eqt Fund,543

Nippon India Eqt Svngs Fund,607 Principal Large Cap Fund,91 Shriram Balanced Advantage,662 Union Large & Midcap,147

Nippon India Equity Hybrid,533 Principal Low Duration,773 Shriram Flexi Cap Fund,482 Union Large Cap,112

Nippon India ETF Bank BeES,288 Principal Midcap Fund,181 Shriram Hybrid Equity,539 Union Liquid,844

Nippon India ETF Consumption,387 Principal Multi Cap Growth,156 Shriram Long Term Equity,265 Union Long Term Equity,269

Nippon India ETF Dividend Opp,355 Principal Nifty 100 Equal Weight,92 Sundaram Arbtg,638 Union Medium Duration Fund,725

Nippon India ETF Gold BeES,1034 Principal Short Term Debt,748 Sundaram Balanced Advtg,663 Union Midcap Fund,187

Nippon India ETF Hang Seng BeES,428 Principal Small Cap,208 Sundaram Banking & PSU Debt,981 Union Overnight,894

Nippon India ETF Infra BeES,312 Principal Tax Svngs Fund,261 Sundaram Bluechip Fund,103 Union Small Cap,213

Nippon India ETF Junior BeES,79 Principal Ultra Short Term,800 Sundaram Corporate Bond,942 Union Value Discovery,231

Nippon India ETF Liquid BeES,834 Quant Absolute,536 Sundaram Debt Oriented Hybrid,589 UTI Arbitrage,641

Nippon India ETF Long Term Gilt,1009 Quant Active,157 Sundaram Diversified Equity,266 UTI Bank ETF,297

Nippon India ETF Nifty 100,80 Quant Consumption,388 Sundaram Equity,158 UTI Banking & Fin Services,298

Nippon India ETF Nifty BeES,81 Quant Dynamic Bond,918 Sundaram Equity Hybrid,540 UTI Banking & PSU Debt Fund,983

Nippon India ETF Nifty CPSE Bond Plus SD,720 Quant ESG Eqt Fund,497 Sundaram Equity Savings,611 UTI Bond Fund,704

Nippon India ETF Nifty IT,333 Quant Focused,93 Sundaram Fin Srvcs Opp Fund,293 UTI Children’s Career Investment,489

Nippon India ETF Nifty Midcap 150,178 Quant Infrastructure,314 Sundaram Global Brand Fund,434 UTI Children’s Career Svngs,552

Nippon India ETF NV20,82 Quant Large & Midcap,143 Sundaram Infrastructure Adv,316 UTI Core Equity,148

Nippon India ETF PSU Bank BeES,289 Quant Liquid Plan,839 Sundaram Large & Midcap,145 UTI Corporate Bond,944

Nippon India ETF Sensex,83 Quant Midcap,182 Sundaram Low Duration,775 UTI Credit Risk,961

Nippon India ETF Sensex Next 50,84 Quant Money Market,862 Sundaram Medium Term Bond,723 UTI Dividend Yld Fund,370

Nippon India ETF Shariah BeES,85 Quant Multi Asset,680 Sundaram Midcap,184 UTI Dynamic Bond,923

Nippon India Floating Rate,989 Quant Small Cap,209 Sundaram Money Fund,842 UTI Equity Savings,614

Nippon India Focused Equity,473 Quant Tax,262 Sundaram Money Market,864 UTI Flexi Cap Fund,490

Nippon India Gilt Securities Fund,1010 Quantum Dynamic Bond,919 Sundaram Overnight,892 UTI Floater,991

Nippon India Gold Savings,1035 Quantum Equity FoF,479 Sundaram Rural & Consumption,390 UTI Gilt,1014

Nippon India Growth Fund,179 Quantum Gold Fund,1036 Sundaram Select Focus Fund,104 UTI Gold ETF,1040

Nippon India Hybrid Bond,585 Quantum Gold Savings,1037 Sundaram Services,359 UTI Healthcare,328

Nippon India Incm Fund,701 Quantum India ESG Eqt,498 Sundaram Short Term Debt,750 UTI Hybrid Equity,544

Nippon India Index Nifty,86 Quantum Liquid Fund,840 Sundaram Small Cap,211 UTI India Consumer Fund,392

Nippon India Index Sensex,87 Quantum Long Term Eqt Value,227 Sundaram Smart NIFTY 100 Equal Wght,105 UTI Infra Fund,319

Nippon India Japan Equity,429 Quantum Multi Asset FOFs,681 Sundaram Ultra Short Term,802 UTI Liquid Cash Fund,845

Nippon India Junior BeES FoF,88 Quantum Nifty ETF,94 Tata Arbitrage,639 UTI Long Term Equity,270

Nippon India Large Cap,89 Quantum Tax Saving Fund,263 Tata Balanced Advantage,664 UTI Mastershare Fund,113

Nippon India Liquid,835 SBI Arbtg Opp Fund,637 Tata Banking & Fin Services,294 UTI Medium Term,726

Nippon India Low Duration,771 SBI Banking & Fin Services,290 Tata Banking & PSU Debt,982 UTI Mid Cap Fund,188

Nippon India Money Market,860 SBI Banking and PSU,980 Tata Digital India,336 UTI MNC Fund,374

Nippon India Multi Asset Fund,679 SBI Bluechip Fund,95 Tata Dynamic Bond Fund,921 UTI Money Market,866

Nippon India Multi Cap,155 SBI Consumption Opportunities,389 Tata Eqt PE Fund,229 UTI Multi Asset,684

Nippon India Nifty Smallcap 250 Index Fu,206 SBI Contra Fund,228 Tata Equity Savings,612 UTI Nifty ETF,114

Nippon India Nivesh Lakshya,690 SBI Corporate Bond,941 Tata Ethical Fund,360 UTI Nifty Index Fund,115

Nippon India Overnight,889 SBI Credit Risk,960 Tata Flexi Cap Fund,483 UTI Nifty Next 50 ETF,116

Nippon India Passive Flexicap FoF,474 SBI Debt Hybrid,587 Tata Focused Eqt,484 UTI Nifty Next 50 Index,117

Nippon India Pharma Fund,325 SBI Dynamic Asset Allocation,661 Tata GSF,1013 UTI Overnight,895

Nippon India Power & Infra,313 SBI Dynamic Bond,920 Tata Hybrid Equity,541 UTI Regular Savings,591

Nippon India Quant,356 SBI Equity Hybrid,537 Tata Income,703 UTI Retrmnt Benefit Pension Fund,553

Nippon India Retrmnt Incm Generation,586 SBI Equity Minimum Variance,357 Tata Index Nifty Fund,106 UTI S&P BSE Sensex Next 50 ETF,118

Nippon India Retrmnt Wealth Creation,475 SBI Equity Savings,610 Tata Index Sensex Fund,107 UTI Sensex ETF,119

Nippon India Short-term Fund,746 SBI ETF 10 Year Gilt,1018 Tata India Consumer,391 UTI Short-term Incm Fund,752

Nippon India Small Cap,207 SBI ETF BSE 100,96 Tata India Pharma & HealthCare,327 UTI Small Cap Fund,214

Nippon India Strategic Debt,721 SBI ETF Gold,1038 Tata India Tax Savings,267 UTI Transp and Log Fund,363

Nippon India Tax Saver (ELSS),258 SBI ETF IT,334 Tata Infra Fund,317 UTI Treasury Advtg Fund,777

Nippon India Ultra Short Duration,798 SBI ETF Nifty 50,97 Tata Large & Midcap,146 UTI Ultra Short Term,804

Nippon India US Eqt Opportunities,430 SBI ETF Nifty Bank,291 Tata Large Cap,108 UTI Unit Linked Insurance Plan Fund,666

Nippon India Value,226 SBI ETF Nifty Next 50,98 Tata Liquid,843 UTI Value Opportunities,232

Nippon India Vision Fund,141 SBI ETF Private Bank,292 Tata Medium Term,724 YES Liquid,846

Parag Parikh Flexi Cap Fund,476 SBI ETF Quality,99 Tata Midcap Growth Fund,185 YES Overnight,896

Parag Parikh Liquid,836 SBI ETF Sensex,100 Tata Money Market,865 YES Ultra Short Term,805

Parag Parikh Tax Saver,259 SBI ETF Sensex Next 50,101 Tata Multi Asset Opp Fund,683

PGIM India Arbitrage,635 SBI Flexicap Fund,480 Tata Nifty ETF,109

PGIM India Banking & PSU Debt,979 SBI Floating Rate Debt Fund,990 Tata Nifty Private Bank ETF,295

PGIM India Credit Risk,959 SBI Focused Equity,481 Tata Overnight,893

76 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.