Page 88 - How to Make Money in Stocks Trilogy

P. 88

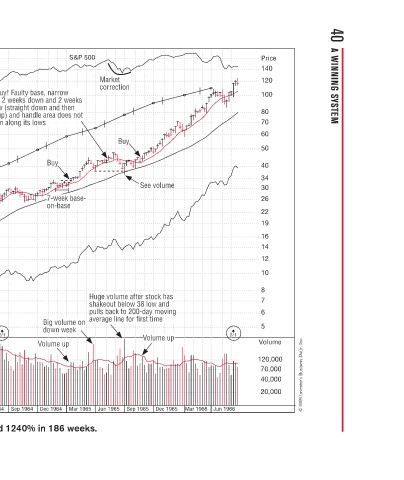

40 A WINNING SYSTEM

Price 140 120 100 80 70 60 50 40 34 30 26 22 19 16 14 12 10 8 7 6 5 Volume 120,000 70,000 40,000 20,000 © 2009 Investor’s Business Daily, Inc.

2/1

Jun 1966

Mar 1966

See volume e e u v e h o t d n w 38 l day moving g v d 0 s Volume up p Volume up e u V Dec 1965 Sep 1965

Market Market e a correction o o ec c co Buy y u Huge volume after stock has u v shakeout below 38 low and bl e t o hk pulls back to 200-day moving pulls back to 200 o b average line for first time g Jun 1965

S&P 500 s k t t t o s u h u v n Mar 1965

Do Not Buy! Faulty base, narrow Do Not Buy! Faulty base, narrow s v-shaped 2 weeks down and 2 weeks w w s up off low (straight down and then o s straight up) and handle area does not dl d h ) ht i dri ift down along its lows drift down along its lows w 2/1 V Sep 1964 Jun 1964 Northwe

w r n w a h d e d d r y y Buy y y y B 7-week base- week base k 7-we 7-we w 7 7 7 on-base s b o Big volume on v k down week e n do p Volume up e u Dec 1964

tr

p

o

Buy: pullback to Buy: pullback to c 10-week moving o average line Volume up Mar 1964 Dec 1963

s

jet planes

New product: jet planes p ct od o p and new route to Japan and new route to Japan J w Market Market k correction o ec e e co u 0 v Add: pullbacks to a 10-week moving week moving m e average line g g g Sep 1963 Jun 1963

n

n

s

Ne

10

A

a

Mar 1963 Dec 1962

Do Not Buy! Stock is

ht u

Northwest Airlines–1962 Weekly Chart 1962 bear market 1962 bear market 1 Do Not Buy! Stock is B B extended straight up d d td from 8 to 14 and it s from 8 to 14 and it’s o a third stage base a third stage base t t Buy y u Huge volume demand e Volume up u Sep 1962 Jun 1962

t

i

t

Price = 20*eps 7.00 6.50 6.00 5.50 5.00 4.50 4.00 3.50 3.00 2.50 2.25 2.00 1.80 1.60 1.50 1.40 1.30 1.20 1.10 1.00 0.90 0.80 0.75 0.70 0.65 0.60 0.55 0.50 0.45 0.40 0.35 0.30 0.25 Mar 1962