Page 623 - MARSIUM'21 COMP OF PAPER

P. 623

602 Nur Fazira & Dr Adaviah (2022)

level of 0.000. This value is indicating smaller than the 0.05 confidence level. The findings of this study show that the factor of

e-service quality of online banking towards customer satisfaction at Bank Islam Malaysia Berhad (BIMB) has a significant impact

on customers.

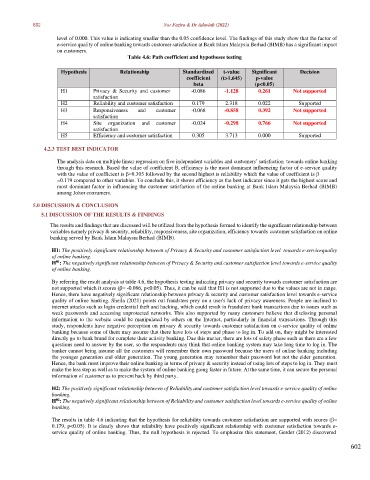

Table 4.6: Path coefficient and hypotheses testing

Hypothesis Relationship Standardized t-value Significant Decision

coefficient (t>1.645) p-value

beta (p<0.05)

H1 Privacy & Security and customer -0.086 -1.128 0.261 Not supported

satisfaction

H2 Reliability and customer satisfaction 0.179 2.318 0.022 Supported

H3 Responsiveness and customer -0.068 -0.858 0.392 Not supported

satisfaction

H4 Site organization and customer -0.024 -0.298 0.766 Not supported

satisfaction

H5 Efficiency and customer satisfaction 0.305 3.713 0.000 Supported

4.2.3 TEST BEST INDICATOR

The analysis data on multiple linear regression on five independent variables and customers’ satisfaction towards online banking

through this research. Based the value of coefficient B, efficiency is the most dominant influencing factor of e-service quality

with the value of coefficient is β=0.305 followed by the second highest is reliability which the value of coefficient is β

=0.179 compared to other variables. To conclude this, it shows efficiency as the best indicator since it gets the highest score and

most dominant factor in influencing the customer satisfaction of the online banking at Bank Islam Malaysia Berhad (BIMB)

among Johor consumers.

5.0 DISCUSSION & CONCLUSION

5.1 DISCUSSION OF THE RESULTS & FINDINGS

The results and findings that are discussed will be utilized from the hypothesis formed to identify the significant relationship between

variables namely privacy & security, reliability, responsiveness, site organization, efficiency towards customer satisfaction on online

banking served by Bank Islam Malaysia Berhad (BIMB).

H1: The positively significant relationship between of Privacy & Security and customer satisfaction level towards e-service quality

of online banking.

01

H : The negatively significant relationship between of Privacy & Security and customer satisfaction level towards e-service quality

of online banking.

By referring the result analysis at table 4.6, the hypothesis testing indicating privacy and security towards customer satisfaction are

not supported which it scores (β= -0.086, p<0.05). Thus, it can be said that H1 is not supported due to the values are not in range.

Hence, there have negatively significant relationship between privacy & security and customer satisfaction level towards e-service

quality of online banking. Sheila (2021) points out fraudsters prey on a user's lack of privacy awareness. People are inclined to

internet attacks such as login credential theft and hacking, which could result in fraudulent bank transactions due to issues such as

weak passwords and accessing unprotected networks. This also supported by many customers believe that disclosing personal

information to the website could be manipulated by others on the Internet, particularly in financial transactions. Through this

study, respondents have negative perception on privacy & security towards customer satisfaction on e-service quality of online

banking because some of them may assume that there have lots of steps and phase to log in. To add on, they might be interested

directly go to bank brand for complete their activity banking. Due this matter, there are lots of safety phase such as there are a few

questions need to answer by the user, so the respondents may think that online banking system may take long time to log in. The

banker cannot being assume all the customers will remember their own password because the users of online banking including

the younger generation and older generation. The young generation may remember their password but not the elder generation.

Hence, the bank must improve their online banking in terms of privacy & security instead of using lots of steps to log in. They must

make the less step as well as to make the system of online banking going faster in future. At the same time, it can secure the personal

information of customer as to prevent hack by third party.

H2: The positively significant relationship between of Reliability and customer satisfaction level towards e-service quality of online

banking.

02

H : The negatively significant relationship between of Reliability and customer satisfaction level towards e-service quality of online

banking.

The results in table 4.6 indicating that the hypothesis for reliability towards customer satisfaction are supported with scores (β=

0.179, p<0.05). It is clearly shows that reliability have positively significant relationship with customer satisfaction towards e-

service quality of online banking. Thus, the null hypothesis is rejected. To emphasize this statement, Gorder (2012) discovered

602