Page 139 - Account 10

P. 139

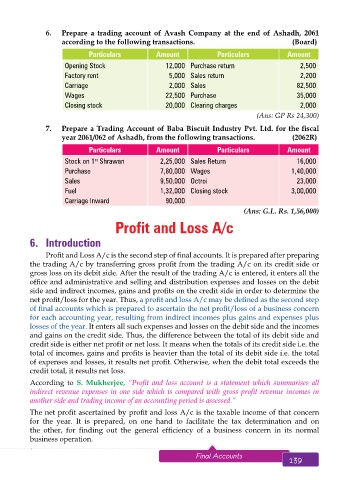

6. Prepare a trading account of Avash Company at the end of Ashadh, 2061

according to the following transactions. (Board)

Particulars Amount Particulars Amount

Opening Stock 12,000 Purchase return 2,500

Factory rent 5,000 Sales return 2,200

Carriage 2,000 Sales 82,500

Wages 22,500 Purchase 35,000

Closing stock 20,000 Clearing charges 2,000

(Ans: GP Rs 24,300)

7. Prepare a Trading Account of Baba Biscuit Industry Pvt. Ltd. for the fiscal

year 2061/062 of Ashadh, from the following transactions. (2062R)

Particulars Amount Particulars Amount

Stock on 1 Shrawan 2,25,000 Sales Return 16,000

st

Purchase 7,80,000 Wages 1,40,000

Sales 9,50,000 Octroi 23,000

Fuel 1,32,000 Closing stock 3,00,000

Carriage Inward 90,000

(Ans: G.L. Rs. 1,56,000)

Profit and Loss A/c

6. Introduction

Profit and Loss A/c is the second step of final accounts. It is prepared after preparing

the trading A/c by transferring gross profit from the trading A/c on its credit side or

gross loss on its debit side. After the result of the trading A/c is entered, it enters all the

office and administrative and selling and distribution expenses and losses on the debit

side and indirect incomes, gains and profits on the credit side in order to determine the

net profit/loss for the year. Thus, a profit and loss A/c may be defined as the second step

of final accounts which is prepared to ascertain the net profit/loss of a business concern

for each accounting year, resulting from indirect incomes plus gains and expenses plus

losses of the year. It enters all such expenses and losses on the debit side and the incomes

and gains on the credit side. Thus, the difference between the total of its debit side and

credit side is either net profit or net loss. It means when the totals of its credit side i.e. the

total of incomes, gains and profits is heavier than the total of its debit side i.e. the total

of expenses and losses, it results net profit. Otherwise, when the debit total exceeds the

credit total, it results net loss.

According to S. Mukherjee, “Profit and loss account is a statement which summarises all

indirect revenue expenses in one side which is compared with gross profit revenue incomes in

another side and trading income of an accounting period is assessed.”

The net profit ascertained by profit and loss A/c is the taxable income of that concern

for the year. It is prepared, on one hand to facilitate the tax determination and on

the other, for finding out the general efficiency of a business concern in its normal

business operation.

138 Aakar’s Office Practice and Accountancy - 10 Final Accounts 139