Page 155 - Account 10

P. 155

ii. Bank Overdraft

It is a kind of facility provided by the banks to their clients to withdraw money from

the banks in excess than their deposit against some security deposit or as the faith and

confidence. This facility is not allowed to every client but only to some prestigious and

regular clients for a short period (mostly of 90 days term) Since, it is to be repaid to the bank

within the specified period, it is regarded as a current or short-term liability for the firm.

iii. Reserve Fund

Future is uncertain; thus, any contingent event may take place in the future. In order

to cover up the financial loss in the future caused by the uncertain incidents, a fund is

created from out of profit each year. Such a fund is known as reserve fund. If it is created

for general purpose, it is called general reserve. But if it is created for a particular purpose,

it is known as specific fund. A specific fund cannot be used in other situation rather than

for the specific incident. Since reserves are created from profit, it is associated with capital.

iv. Bills Receivables and Payable

The person or firm, who is entitled to receive money, draws a bill and gets it accepted

from the person who is liable to pay the bill. As such, a bill is created between two parties

and the same bill is bills receivables (B/R) to the former and bills payables (B/P) to the

latter. Thus, from the drawer’s point of view, it is bills receivable, an asset to him and

from the acceptor’s point of view, it is bills payable, a liability to him.

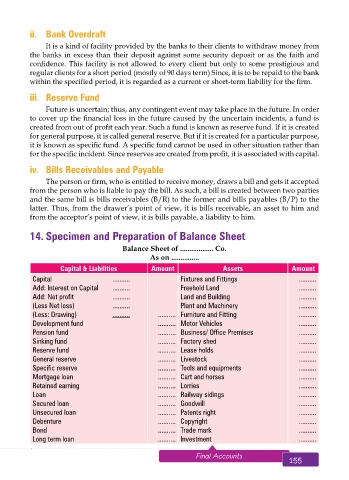

14. Specimen and Preparation of Balance Sheet

Balance Sheet of .................. Co.

As on ...............

Capital & Liabilities Amount Assets Amount

Capital .......... Fixtures and Fittings ..........

Add: Interest on Capital .......... Freehold Land ..........

Add: Net profit .......... Land and Building ..........

(Less Net loss) .......... Plant and Machinery ..........

(Less: Drawing) .......... .......... Furniture and Fitting ..........

Development fund .......... Motor Vehicles ..........

Pension fund .......... Business/ Office Premises ..........

Sinking fund .......... Factory shed ..........

Reserve fund .......... Lease holds ..........

General reserve .......... Livestock ..........

Specific reserve .......... Tools and equipments ..........

Mortgage loan .......... Cart and horses ..........

Retained earning .......... Lorries ..........

Loan .......... Railway sidings ..........

Secured loan .......... Goodwill ..........

Unsecured loan .......... Patents right ..........

Debenture .......... Copyright ..........

Bond .......... Trade mark ..........

Long term loan .......... Investment ..........

154 Aakar’s Office Practice and Accountancy - 10 Final Accounts 155