Page 150 - Account 10

P. 150

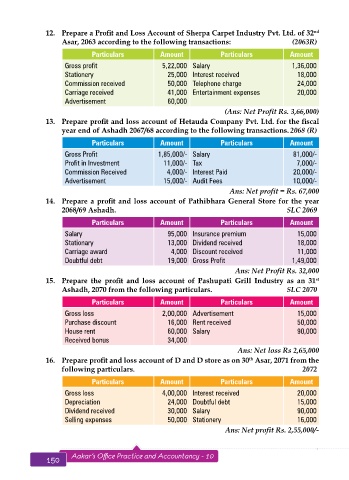

12. Prepare a Profit and Loss Account of Sherpa Carpet Industry Pvt. Ltd. of 32

nd

Asar, 2063 according to the following transactions: (2063R)

Particulars Amount Particulars Amount

Gross profit 5,22,000 Salary 1,36,000

Stationery 25,000 Interest received 18,000

Commission received 50,000 Telephone charge 24,000

Carriage received 41,000 Entertainment expenses 20,000

Advertisement 60,000

(Ans: Net Profit Rs. 3,66,000)

13. Prepare profit and loss account of Hetauda Company Pvt. Ltd. for the fiscal

year end of Ashadh 2067/68 according to the following transactions. 2068 (R)

Particulars Amount Particulars Amount

Gross Profit 1,85,000/- Salary 81,000/-

Profit in Investment 11,000/- Tax 7,000/-

Commission Received 4,000/- Interest Paid 20,000/-

Advertisement 15,000/- Audit Fees 10,000/-

Ans: Net profit = Rs. 67,000

14. Prepare a profit and loss account of Pathibhara General Store for the year

2068/69 Ashadh. SLC 2069

Particulars Amount Particulars Amount

Salary 95,000 Insurance premium 15,000

Stationary 13,000 Dividend received 18,000

Carriage award 4,000 Discount received 11,000

Doubtful debt 19,000 Gross Profit 1,49,000

Ans: Net Profit Rs. 32,000

15. Prepare the profit and loss account of Pashupati Grill Industry as an 31

st

Ashadh, 2070 from the following particulars. SLC 2070

Particulars Amount Particulars Amount

Gross loss 2,00,000 Advertisement 15,000

Purchase discount 16,000 Rent received 50,000

House rent 60,000 Salary 90,000

Received bonus 34,000

Ans: Net loss Rs 2,65,000

16. Prepare profit and loss account of D and D store as on 30 Asar, 2071 from the

th

following particulars. 2072

Particulars Amount Particulars Amount

Gross loss 4,00,000 Interest received 20,000

Depreciation 24,000 Doubtful debt 15,000

Dividend received 30,000 Salary 90,000

Selling expenses 50,000 Stationery 16,000

Ans: Net profit Rs. 2,55,000/-

150 Aakar’s Office Practice and Accountancy - 10 Final Accounts 151