Page 219 - Account 10

P. 219

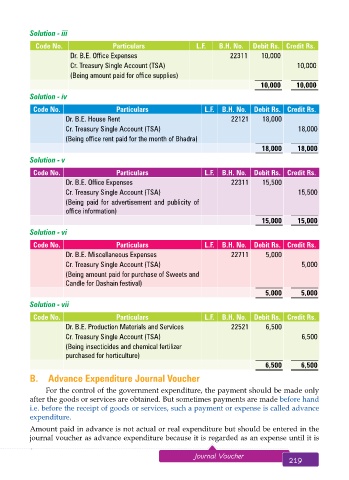

Solution - iii

Code No. Particulars L.F. B.H. No. Debit Rs. Credit Rs.

Dr. B.E. Office Expenses 22311 10,000

Cr. Treasury Single Account (TSA) 10,000

(Being amount paid for office supplies)

10,000 10,000

Solution - iv

Code No. Particulars L.F. B.H. No. Debit Rs. Credit Rs.

Dr. B.E. House Rent 22121 18,000

Cr. Treasury Single Account (TSA) 18,000

(Being office rent paid for the month of Bhadra)

18,000 18,000

Solution - v

Code No. Particulars L.F. B.H. No. Debit Rs. Credit Rs.

Dr. B.E. Office Expenses 22311 15,500

Cr. Treasury Single Account (TSA) 15,500

(Being paid for advertisement and publicity of

office information)

15,000 15,000

Solution - vi

Code No. Particulars L.F. B.H. No. Debit Rs. Credit Rs.

Dr. B.E. Miscellaneous Expenses 22711 5,000

Cr. Treasury Single Account (TSA) 5,000

(Being amount paid for purchase of Sweets and

Candle for Dashain festival)

5,000 5,000

Solution - vii

Code No. Particulars L.F. B.H. No. Debit Rs. Credit Rs.

Dr. B.E. Production Materials and Services 22521 6,500

Cr. Treasury Single Account (TSA) 6,500

(Being insecticides and chemical fertilizer

purchased for horticulture)

6,500 6,500

B. Advance Expenditure Journal Voucher

For the control of the government expenditure, the payment should be made only

after the goods or services are obtained. But sometimes payments are made before hand

i.e. before the receipt of goods or services, such a payment or expense is called advance

expenditure.

Amount paid in advance is not actual or real expenditure but should be entered in the

journal voucher as advance expenditure because it is regarded as an expense until it is

218 Aakar’s Office Practice and Accountancy - 10 Journal Voucher 219