Page 299 - Account 10

P. 299

viii. Loan payable: Amount taken from other office is known as loan payable. It can be

calculated as:

Loan payable

= Total expenses upto current month – total release received + cash balance +

bank balance + loan/deposit provided

ix. Loan receivables is calculated as:

Loan receivable

= Total release – total expenditures – bank balance – cash balance + loan taken

x. Submitted by: The name and signature of the person submitting if for final approval

along with date is given.

xi. Approved by: The name and signature of ther person accepting and approved as

final approval along with date is given.

xii. The common rule is

TR = TE + BB + CB or PF + L.P + A/c P + A/c R - L.R

Where,

T.R. = Total Revolving fond L.P. = Loan provided

B.B = Bank Balance A/c R. = Account receivable

C.B. = Cash Balance L.A. = Loan Receivable

P.F. = Petty Cash Fund A/c P = Account payable

Generally, bank balance, cash balance and budget expenditure amount should be equal

to the budget release. In the event of any difference, the difference will be equal to the

advance or loan given but not yet cleared or received.

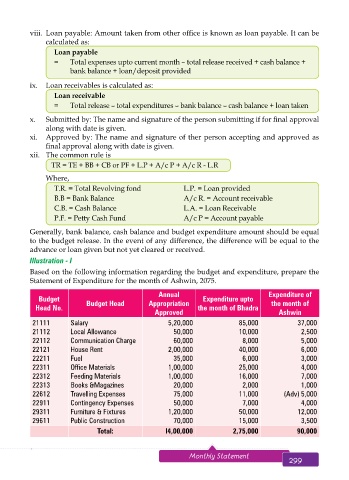

Illustration - I

Based on the following information regarding the budget and expenditure, prepare the

Statement of Expenditure for the month of Ashwin, 2075.

Annual Expenditure of

Budget Expenditure upto

Head No. Budget Head Appropriation the month of Bhadra the month of

Approved Ashwin

21111 Salary 5,20,000 85,000 37,000

21112 Local Allowance 50,000 10,000 2,500

22112 Communication Charge 60,000 8,000 5,000

22121 House Rent 2,00,000 40,000 6,000

22211 Fuel 35,000 6,000 3,000

22311 Office Materials 1,00,000 25,000 4,000

22312 Feeding Materials 1,00,000 16,000 7,000

22313 Books &Magazines 20,000 2,000 1,000

22612 Travelling Expenses 75,000 11,000 (Adv) 5,000

22911 Contingency Expenses 50,000 7,000 4,000

29311 Furniture & Fixtures 1,20,000 50,000 12,000

29611 Public Construction 70,000 15,000 3,500

Total: l4,00,000 2,75,000 90,000

298 Aakar’s Office Practice and Accountancy - 10 Monthly Statement 299