Page 305 - Account 10

P. 305

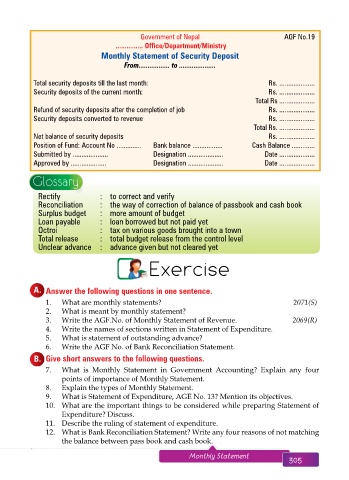

Government of Nepal AGF No.19

............... Office/Department/Ministry

Monthly Statement of Security Deposit

From................. to ....................

Total security deposits till the last month: Rs. ....................

Security deposits of the current month: Rs. ....................

Total Rs ....................

Refund of security deposits after the completion of job Rs. ....................

Security deposits converted to revenue Rs. ....................

Total Rs. ....................

Net balance of security deposits Rs. ....................

Position of Fund: Account No .............. Bank balance ................. Cash Balance .............

Submitted by .................... Designation .................... Date ....................

Approved by .................... Designation .................... Date ....................

Glossary

Rectify : to correct and verify

Reconciliation : the way of correction of balance of passbook and cash book

Surplus budget : more amount of budget

Loan payable : loan borrowed but not paid yet

Octroi : tax on various goods brought into a town

Total release : total budget release from the control level

Unclear advance : advance given but not cleared yet

Exercise

A. Answer the following questions in one sentence.

1. What are monthly statements? 2071(S)

2. What is meant by monthly statement?

3. Write the AGF.No. of Monthly Statement of Revenue. 2069(R)

4. Write the names of sections written in Statement of Expenditure.

5. What is statement of outstanding advance?

6. Write the AGF No. of Bank Reconciliation Statement.

B. Give short answers to the following questions.

7. What is Monthly Statement in Government Accounting? Explain any four

points of importance of Monthly Statement.

8. Explain the types of Monthly Statement.

9. What is Statement of Expenditure, AGE No. 13? Mention its objectives.

10. What are the important things to be considered while preparing Statement of

Expenditure? Discuss.

11. Describe the ruling of statement of expenditure.

12. What is Bank Reconciliation Statement? Write any four reasons of not matching

the balance between pass book and cash book.

304 Aakar’s Office Practice and Accountancy - 10 Monthly Statement 305