Page 303 - Account 10

P. 303

are recorded into the Bank Cash Book and it shows the bank balance at the end of each

month. Bank Cash Book is a general ledger of an operating level office and, thus it also

shows the balances of other accounts like cash, budget expenditure, advance expenditure

and miscellaneous, etc. In the case of Bank Reconciliation Statement, it is discussed here

about bank balance shown by Bank Cash Book to reconcile with the balance shown by

Pass Book.

On the other part, bank also maintains the accounts of each office separately to record its

deposits and withdrawals made from time to time. It is known as bank statement with

client’s account or Pass Book in common term.

The Bank Cash Book maintained by an office and the Pass Book maintained by the bank

in the name of the office record the same transactions. Thus, the two balances should tally.

It means the Dr. balance of Bank Cash Book should tally the Cr. balance of Pass Book and

vice versa. At the end of each period, a month, the balances of these two books may differ

due to some reasons. The reason may be:

Cheque issued but not presented till the date.

Cheques deposited but not collected till the date.

Errors in bank cash book or pass book.

Undercast or overcast in bank cash book or pass book.

Bank charges commission etc. directly charged by the bank for its services, etc. but

not recorded in bank cash book.

Revenue collected directly by bank but not recorded in bank cash book.

A statement is prepared at the end of each month under operating level accounting

according to the format designed to AGF No. 15 to match the balances of Bank Cash

Book and Pass Book by identifying and adjusting the causes of difference between them.

This statement is known as Bank Reconciliation Statement. Hence, a Bank Reconciliation

Statement may be defined as a statement prepared by an operating level office under

the prescribed format to match the balances shown by Bank Cash Book and Pass Book

by adjusting the causes of differences between them. It is prepared to control over the

leakage and corruption of fund and to overcome the confusions in the dealings between

the office and its bank. It is prepared as AGF No. 15 format.

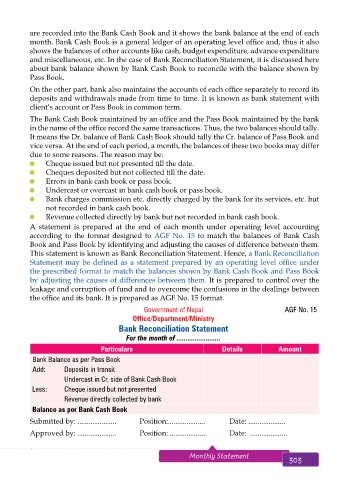

Government of Nepal AGF No. 15

Office/Department/Ministry

Bank Reconciliation Statement

For the month of ........................

Particulars Details Amount

Bank Balance as per Pass Book

Add: Deposits in transit

Undercast in Cr. side of Bank Cash Book

Less: Cheque issued but not presented

Revenue directly collected by bank

Balance as per Bank Cash Book

Submitted by: ..................... Position:.................... Date: ....................

Approved by: ..................... Position: .................... Date: ....................

302 Aakar’s Office Practice and Accountancy - 10 Monthly Statement 303