Page 302 - Account 10

P. 302

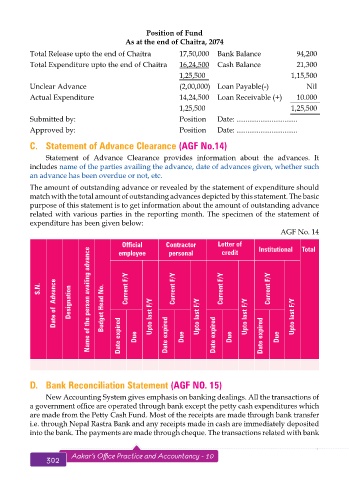

Position of Fund

As at the end of Chaitra, 2074

Total Release upto the end of Chaitra 17,50,000 Bank Balance 94,200

Total Expenditure upto the end of Chaitra 16,24,500 Cash Balance 21,300

1,25,500 1,15,500

Unclear Advance (2,00,000) Loan Payable(-) Nil

Actual Expenditure 14,24,500 Loan Receivable (+) 10.000

1,25,500 1,25,500

Submitted by: Position Date: .................................

Approved by: Position Date: .................................

C. Statement of Advance Clearance (AGF No.14)

Statement of Advance Clearance provides information about the advances. It

includes name of the parties availing the advance, date of advances given, whether such

an advance has been overdue or not, etc.

The amount of outstanding advance or revealed by the statement of expenditure should

match with the total amount of outstanding advances depicted by this statement. The basic

purpose of this statement is to get information about the amount of outstanding advance

related with various parties in the reporting month. The specimen of the statement of

expenditure has been given below:

AGF No. 14

Official Contractor Letter of Institutional Total

Name of the person availing advance

credit

employee

personal

Date of Advance Designation Budget Head No. Date expired Due Upto last F/Y Date expired Due Upto last F/Y Date expired Due Upto last F/Y Date expired Due Upto last F/Y

S.N. Current F/Y Current F/Y Current F/Y Current F/Y

D. Bank Reconciliation Statement (AGF NO. 15)

New Accounting System gives emphasis on banking dealings. All the transactions of

a government office are operated through bank except the petty cash expenditures which

are made from the Petty Cash Fund. Most of the receipts are made through bank transfer

i.e. through Nepal Rastra Bank and any receipts made in cash are immediately deposited

into the bank. The payments are made through cheque. The transactions related with bank

302 Aakar’s Office Practice and Accountancy - 10 Monthly Statement 303