Page 141 - Office Practice and Accounting 10

P. 141

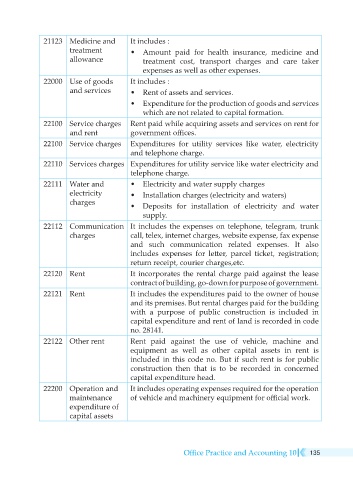

21123 Medicine and It includes :

treatment • Amount paid for health insurance, medicine and

allowance treatment cost, transport charges and care taker

expenses as well as other expenses.

22000 Use of goods It includes :

and services • Rent of assets and services.

• Expenditure for the production of goods and services

which are not related to capital formation.

22100 Service charges Rent paid while acquiring assets and services on rent for

and rent government offices.

22100 Service charges Expenditures for utility services like water, electricity

and telephone charge.

22110 Services charges Expenditures for utility service like water electricity and

telephone charge.

22111 Water and • Electricity and water supply charges

electricity • Installation charges (electricity and waters)

charges • Deposits for installation of electricity and water

supply.

22112 Communication It includes the expenses on telephone, telegram, trunk

charges call, telex, internet charges, website expense, fax expense

and such communication related expenses. It also

includes expenses for letter, parcel ticket, registration;

return receipt, courier charges,etc.

22120 Rent It incorporates the rental charge paid against the lease

contract of building, go-down for purpose of government.

22121 Rent It includes the expenditures paid to the owner of house

and its premises. But rental charges paid for the building

with a purpose of public construction is included in

capital expenditure and rent of land is recorded in code

no. 28141.

22122 Other rent Rent paid against the use of vehicle, machine and

equipment as well as other capital assets in rent is

included in this code no. But if such rent is for public

construction then that is to be recorded in concerned

capital expenditure head.

22200 Operation and It includes operating expenses required for the operation

maintenance of vehicle and machinery equipment for official work.

expenditure of

capital assets

Office Practice and Accounting 10 135