Page 145 - Office Practice and Accounting 10

P. 145

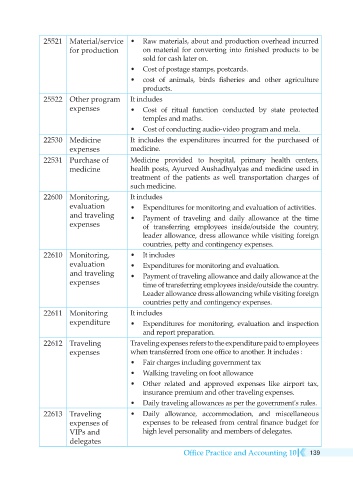

25521 Material/service • Raw materials, about and production overhead incurred

for production on material for converting into finished products to be

sold for cash later on.

• Cost of postage stamps, postcards.

• cost of animals, birds fisheries and other agriculture

products.

25522 Other program It includes

expenses • Cost of ritual function conducted by state protected

temples and maths.

• Cost of conducting audio-video program and mela.

22530 Medicine It includes the expenditures incurred for the purchased of

expenses medicine.

22531 Purchase of Medicine provided to hospital, primary health centers,

medicine health posts, Ayurved Aushadhyalyas and medicine used in

treatment of the patients as well transportation charges of

such medicine.

22600 Monitoring, It includes

evaluation • Expenditures for monitoring and evaluation of activities.

and traveling • Payment of traveling and daily allowance at the time

expenses of transferring employees inside/outside the country,

leader allowance, dress allowance while visiting foreign

countries, petty and contingency expenses.

22610 Monitoring, • It includes

evaluation • Expenditures for monitoring and evaluation.

and traveling • Payment of traveling allowance and daily allowance at the

expenses time of transferring employees inside/outside the country.

Leader allowance dress allowancing while visiting foreign

countries petty and contingency expenses.

22611 Monitoring It includes

expenditure • Expenditures for monitoring, evaluation and inspection

and report preparation.

22612 Traveling Traveling expenses refers to the expenditure paid to employees

expenses when transferred from one office to another. It includes :

• Fair charges including government tax

• Walking traveling on foot allowance

• Other related and approved expenses like airport tax,

insurance premium and other traveling expenses.

• Daily traveling allowances as per the government's rules.

22613 Traveling • Daily allowance, accommodation, and miscellaneous

expenses of expenses to be released from central finance budget for

VIPs and high level personality and members of delegates.

delegates

Office Practice and Accounting 10 139