Page 144 - Office Practice and Accounting 10

P. 144

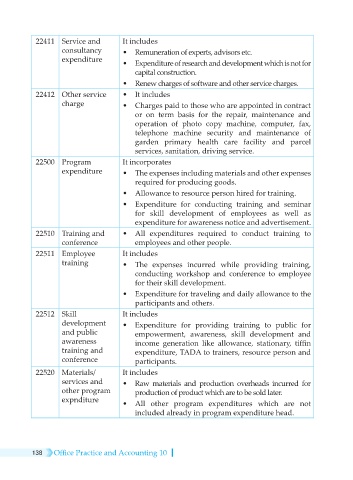

22411 Service and It includes

consultancy • Remuneration of experts, advisors etc.

expenditure • Expenditure of research and development which is not for

capital construction.

• Renew charges of software and other service charges.

22412 Other service • It includes

charge • Charges paid to those who are appointed in contract

or on term basis for the repair, maintenance and

operation of photo copy machine, computer, fax,

telephone machine security and maintenance of

garden primary health care facility and parcel

services, sanitation, driving service.

22500 Program It incorporates

expenditure • The expenses including materials and other expenses

required for producing goods.

• Allowance to resource person hired for training.

• Expenditure for conducting training and seminar

for skill development of employees as well as

expenditure for awareness notice and advertisement.

22510 Training and • All expenditures required to conduct training to

conference employees and other people.

22511 Employee It includes

training • The expenses incurred while providing training,

conducting workshop and conference to employee

for their skill development.

• Expenditure for traveling and daily allowance to the

participants and others.

22512 Skill It includes

development • Expenditure for providing training to public for

and public empowerment, awareness, skill development and

awareness income generation like allowance, stationary, tiffin

training and expenditure, TADA to trainers, resource person and

conference participants.

22520 Materials/ It includes

services and • Raw materials and production overheads incurred for

other program production of product which are to be sold later.

expnditure • All other program expenditures which are not

included already in program expenditure head.

138 Office Practice and Accounting 10