Page 205 - Office Practice and Accounting 10

P. 205

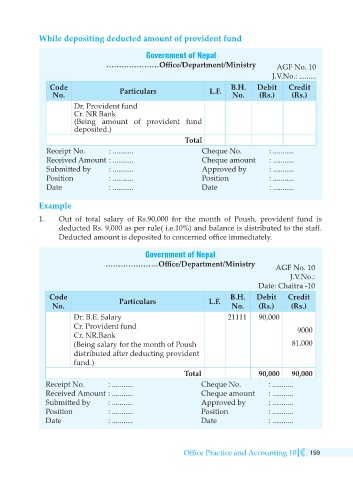

While depositing deducted amount of provident fund

Government of Nepal

…………………Office/Department/Ministry AGF No. 10

J.V.No.: .........

Code Particulars L.F. B.H. Debit Credit

No. No. (Rs.) (Rs.)

Dr. Provident fund

Cr. NR Bank

(Being amount of provident fund

deposited.)

Total

Receipt No. : ........... Cheque No. : ...........

Received Amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

Example

1. Out of total salary of Rs.90,000 for the month of Poush, provident fund is

deducted Rs. 9,000 as per rule( i.e.10%) and balance is distributed to the staff.

Deducted amount is deposited to concerned office immediately.

Government of Nepal

…………………Office/Department/Ministry AGF No. 10

J.V.No.:

Date: Chaitra -10

Code Particulars L.F. B.H. Debit Credit

No. No. (Rs.) (Rs.)

Dr. B.E. Salary 21111 90,000

Cr. Provident fund 9000

Cr. NR.Bank

(Being salary for the month of Poush 81,000

distributed after deducting provident

fund.)

Total 90,000 90,000

Receipt No. : ........... Cheque No. : ...........

Received Amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

Office Practice and Accounting 10 199