Page 207 - Office Practice and Accounting 10

P. 207

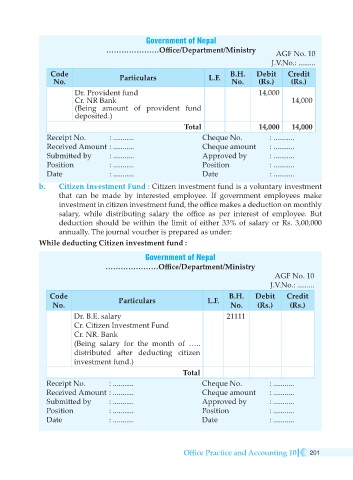

Government of Nepal

…………………Office/Department/Ministry AGF No. 10

J.V.No.: .........

Code Particulars L.F. B.H. Debit Credit

No. No. (Rs.) (Rs.)

Dr. Provident fund 14,000

Cr. NR Bank 14,000

(Being amount of provident fund

deposited.)

Total 14,000 14,000

Receipt No. : ........... Cheque No. : ...........

Received Amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

b. Citizen Investment Fund : Citizen investment fund is a voluntary investment

that can be made by interested employee. If government employees make

investment in citizen investment fund, the office makes a deduction on monthly

salary, while distributing salary the office as per interest of employee. But

deduction should be within the limit of either 33% of salary or Rs. 3,00,000

annually. The journal voucher is prepared as under:

While deducting Citizen investment fund :

Government of Nepal

…………………Office/Department/Ministry

AGF No. 10

J.V.No.: .........

Code B.H. Debit Credit

No. Particulars L.F. No. (Rs.) (Rs.)

Dr. B.E. salary 21111

Cr. Citizen Investment Fund

Cr. NR. Bank

(Being salary for the month of …..

distributed after deducting citizen

investment fund.)

Total

Receipt No. : ........... Cheque No. : ...........

Received Amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

While depositing deducted amount of Provident fund :

Office Practice and Accounting 10 201