Page 200 - Office Practice and Accounting 10

P. 200

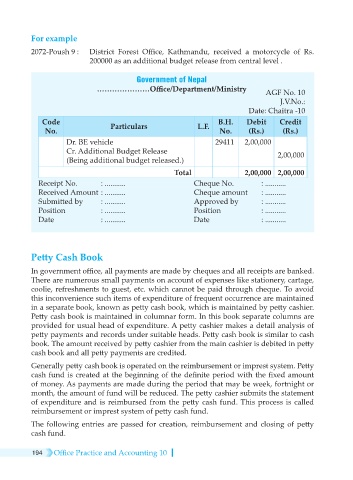

For example

2072-Poush 9 : District Forest Office, Kathmandu, received a motorcycle of Rs.

200000 as an additional budget release from central level .

Government of Nepal

…………………Office/Department/Ministry AGF No. 10

J.V.No.:

Date: Chaitra -10

Code B.H. Debit Credit

No. Particulars L.F. No. (Rs.) (Rs.)

Dr. BE vehicle 29411 2,00,000

Cr. Additional Budget Release 2,00,000

(Being additional budget released.)

Total 2,00,000 2,00,000

Receipt No. : ........... Cheque No. : ...........

Received Amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

Petty Cash Book

In government office, all payments are made by cheques and all receipts are banked.

There are numerous small payments on account of expenses like stationery, cartage,

coolie, refreshments to guest, etc. which cannot be paid through cheque. To avoid

this inconvenience such items of expenditure of frequent occurrence are maintained

in a separate book, known as petty cash book, which is maintained by petty cashier.

Petty cash book is maintained in columnar form. In this book separate columns are

provided for usual head of expenditure. A petty cashier makes a detail analysis of

petty payments and records under suitable heads. Petty cash book is similar to cash

book. The amount received by petty cashier from the main cashier is debited in petty

cash book and all petty payments are credited.

Generally petty cash book is operated on the reimbursement or imprest system. Petty

cash fund is created at the beginning of the definite period with the fixed amount

of money. As payments are made during the period that may be week, fortnight or

month, the amount of fund will be reduced. The petty cashier submits the statement

of expenditure and is reimbursed from the petty cash fund. This process is called

reimbursement or imprest system of petty cash fund.

The following entries are passed for creation, reimbursement and closing of petty

cash fund.

194 Office Practice and Accounting 10