Page 269 - Office Practice and Accounting 10

P. 269

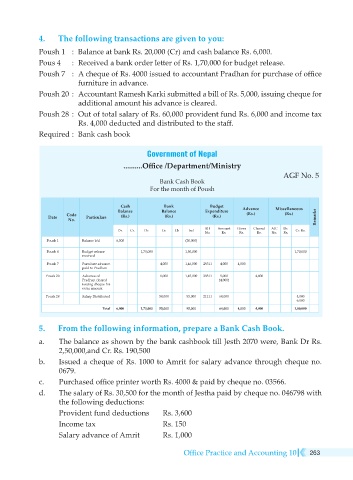

4. The following transactions are given to you:

Poush 1 : Balance at bank Rs. 20,000 (Cr) and cash balance Rs. 6,000.

Pous 4 : Received a bank order letter of Rs. 1,70,000 for budget release.

Poush 7 : A cheque of Rs. 4000 issued to accountant Pradhan for purchase of office

furniture in advance.

Poush 20 : Accountant Ramesh Karki submitted a bill of Rs. 5,000, issuing cheque for

additional amount his advance is cleared.

Poush 28 : Out of total salary of Rs. 60,000 provident fund Rs. 6,000 and income tax

Rs. 4,000 deducted and distributed to the staff.

Required : Bank cash book

Government of Nepal

..........Office /Department/Ministry

AGF No. 5

Bank Cash Book

For the month of Poush

Cash Bank Budget Advance Miscellaneous

Balance Balance Expenditure (Rs.) (Rs.)

Date Code Particulars (Rs.) (Rs.) (Rs.) Remarks

No.

BH Amount Given Cleared A/C Dr.

Dr. Cr. Dr. Cr. Ch bal Cr. Rs.

No. Rs. Rs. Rs. No. Rs.

Poush 1 Balance b/d 6,000 (20,000)

Poush 4 Budget release 1,70,000 1,50,000 1,70,000

received

Poush 7 Furniture advance 4,000 1,46,000 29311 4,000 4,000

paid to Pradhan

Poush 20 Advance of 1,000 1,45,000 29311 5,000 4,000

Pradhan cleared (4,000)

issuing cheque for

extra amount

Poush 28 Salary Distributed 50,000 95,000 21111 60,000 4,000

6,000

Total 6,000 1,70,000 55,000 95,000 64,000 4,000 4,000 1,80,000

5. From the following information, prepare a Bank Cash Book.

a. The balance as shown by the bank cashbook till Jesth 2070 were, Bank Dr Rs.

2,50,000,and Cr. Rs. 190,500

b. Issued a cheque of Rs. 1000 to Amrit for salary advance through cheque no.

0679.

c. Purchased office printer worth Rs. 4000 & paid by cheque no. 03566.

d. The salary of Rs. 30,500 for the month of Jestha paid by cheque no. 046798 with

the following deductions:

Provident fund deductions Rs. 3,600

Income tax Rs. 150

Salary advance of Amrit Rs. 1,000

Office Practice and Accounting 10 263