Page 271 - Office Practice and Accounting 10

P. 271

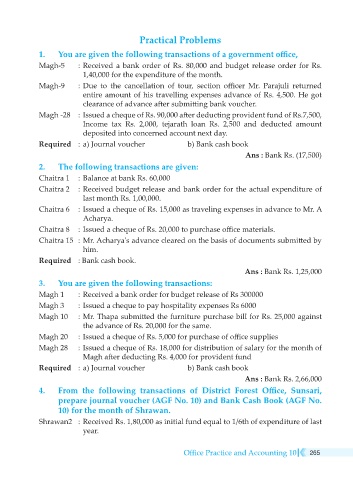

Practical Problems

1. You are given the following transactions of a government office,

Magh-5 : Received a bank order of Rs. 80,000 and budget release order for Rs.

1,40,000 for the expenditure of the month.

Magh-9 : Due to the cancellation of tour, section officer Mr. Parajuli returned

entire amount of his travelling expenses advance of Rs. 4,500. He got

clearance of advance after submitting bank voucher.

Magh -28 : Issued a cheque of Rs. 90,000 after deducting provident fund of Rs.7,500,

Income tax Rs. 2,000, tejarath loan Rs. 2,500 and deducted amount

deposited into concerned account next day.

Required : a) Journal voucher b) Bank cash book

Ans : Bank Rs. (17,500)

2. The following transactions are given:

Chaitra 1 : Balance at bank Rs. 60,000

Chaitra 2 : Received budget release and bank order for the actual expenditure of

last month Rs. 1,00,000.

Chaitra 6 : Issued a cheque of Rs. 15,000 as traveling expenses in advance to Mr. A

Acharya.

Chaitra 8 : Issued a cheque of Rs. 20,000 to purchase office materials.

Chaitra 15 : Mr. Acharya's advance cleared on the basis of documents submitted by

him.

Required : Bank cash book.

Ans : Bank Rs. 1,25,000

3. You are given the following transactions:

Magh 1 : Received a bank order for budget release of Rs 300000

Magh 3 : Issued a cheque to pay hospitality expenses Rs 6000

Magh 10 : Mr. Thapa submitted the furniture purchase bill for Rs. 25,000 against

the advance of Rs. 20,000 for the same.

Magh 20 : Issued a cheque of Rs. 5,000 for purchase of office supplies

Magh 28 : Issued a cheque of Rs. 18,000 for distribution of salary for the month of

Magh after deducting Rs. 4,000 for provident fund

Required : a) Journal voucher b) Bank cash book

Ans : Bank Rs. 2,66,000

4. From the following transactions of District Forest Office, Sunsari,

prepare journal voucher (AGF No. 10) and Bank Cash Book (AGF No.

10) for the month of Shrawan.

Shrawan2 : Received Rs. 1,80,000 as initial fund equal to 1/6th of expenditure of last

year.

Office Practice and Accounting 10 265