Page 274 - Office Practice and Accounting 10

P. 274

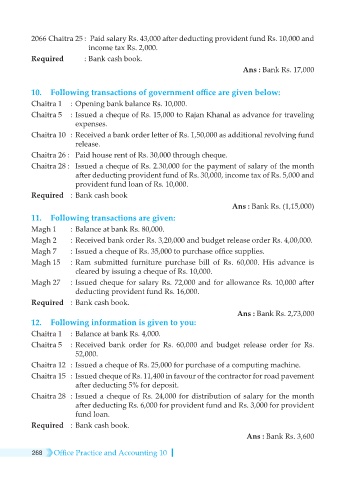

2066 Chaitra 25 : Paid salary Rs. 43,000 after deducting provident fund Rs. 10,000 and

income tax Rs. 2,000.

Required : Bank cash book.

Ans : Bank Rs. 17,000

10. Following transactions of government office are given below:

Chaitra 1 : Opening bank balance Rs. 10,000.

Chaitra 5 : Issued a cheque of Rs. 15,000 to Rajan Khanal as advance for traveling

expenses.

Chaitra 10 : Received a bank order letter of Rs. 1,50,000 as additional revolving fund

release.

Chaitra 26 : Paid house rent of Rs. 30,000 through cheque.

Chaitra 28 : Issued a cheque of Rs. 2.30,000 for the payment of salary of the month

after deducting provident fund of Rs. 30,000, income tax of Rs. 5,000 and

provident fund loan of Rs. 10,000.

Required : Bank cash book

Ans : Bank Rs. (1,15,000)

11. Following transactions are given:

Magh 1 : Balance at bank Rs. 80,000.

Magh 2 : Received bank order Rs. 3,20,000 and budget release order Rs. 4,00,000.

Magh 7 : Issued a cheque of Rs. 35,000 to purchase office supplies.

Magh 15 : Ram submitted furniture purchase bill of Rs. 60,000. His advance is

cleared by issuing a cheque of Rs. 10,000.

Magh 27 : Issued cheque for salary Rs. 72,000 and for allowance Rs. 10,000 after

deducting provident fund Rs. 16,000.

Required : Bank cash book.

Ans : Bank Rs. 2,73,000

12. Following information is given to you:

Chaitra 1 : Balance at bank Rs. 4,000.

Chaitra 5 : Received bank order for Rs. 60,000 and budget release order for Rs.

52,000.

Chaitra 12 : Issued a cheque of Rs. 25,000 for purchase of a computing machine.

Chaitra 15 : Issued cheque of Rs. 11,400 in favour of the contractor for road pavement

after deducting 5% for deposit.

Chaitra 28 : Issued a cheque of Rs. 24,000 for distribution of salary for the month

after deducting Rs. 6,000 for provident fund and Rs. 3,000 for provident

fund loan.

Required : Bank cash book.

Ans : Bank Rs. 3,600

268 Office Practice and Accounting 10