Page 272 - Office Practice and Accounting 10

P. 272

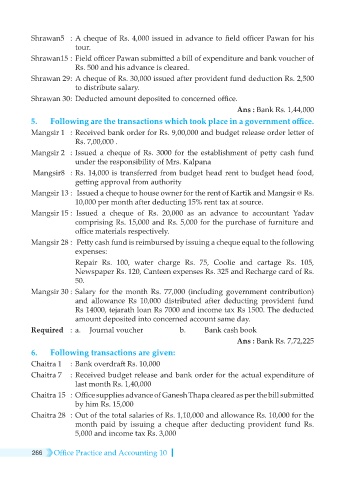

Shrawan5 : A cheque of Rs. 4,000 issued in advance to field officer Pawan for his

tour.

Shrawan15 : Field officer Pawan submitted a bill of expenditure and bank voucher of

Rs. 500 and his advance is cleared.

Shrawan 29 : A cheque of Rs. 30,000 issued after provident fund deduction Rs. 2,500

to distribute salary.

Shrawan 30 : Deducted amount deposited to concerned office.

Ans : Bank Rs. 1,44,000

5. Following are the transactions which took place in a government office.

Mangsir 1 : Received bank order for Rs. 9,00,000 and budget release order letter of

Rs. 7,00,000 .

Mangsir 2 : Issued a cheque of Rs. 3000 for the establishment of petty cash fund

under the responsibility of Mrs. Kalpana

Mangsir8 : Rs. 14,000 is transferred from budget head rent to budget head food,

getting approval from authority

Mangsir 13 : Issued a cheque to house owner for the rent of Kartik and Mangsir @ Rs.

10,000 per month after deducting 15% rent tax at source.

Mangsir 15 : Issued a cheque of Rs. 20,000 as an advance to accountant Yadav

comprising Rs. 15,000 and Rs. 5,000 for the purchase of furniture and

office materials respectively.

Mangsir 28 : Petty cash fund is reimbursed by issuing a cheque equal to the following

expenses:

Repair Rs. 100, water charge Rs. 75, Coolie and cartage Rs. 105,

Newspaper Rs. 120, Canteen expenses Rs. 325 and Recharge card of Rs.

50.

Mangsir 30 : Salary for the month Rs. 77,000 (including government contribution)

and allowance Rs 10,000 distributed after deducting provident fund

Rs 14000, tejarath loan Rs 7000 and income tax Rs 1500. The deducted

amount deposited into concerned account same day.

Required : a. Journal voucher b. Bank cash book

Ans : Bank Rs. 7,72,225

6. Following transactions are given:

Chaitra 1 : Bank overdraft Rs. 10,000

Chaitra 7 : Received budget release and bank order for the actual expenditure of

last month Rs. 1,40,000

Chaitra 15 : Office supplies advance of Ganesh Thapa cleared as per the bill submitted

by him Rs. 15,000

Chaitra 28 : Out of the total salaries of Rs. 1,10,000 and allowance Rs. 10,000 for the

month paid by issuing a cheque after deducting provident fund Rs.

5,000 and income tax Rs. 3,000

266 Office Practice and Accounting 10