Page 120 - Office Practice and Accounting -9

P. 120

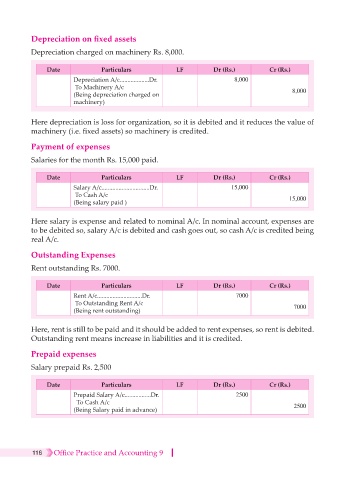

Depreciation on fixed assets

Depreciation charged on machinery Rs. 8,000.

Date Particulars LF Dr (Rs.) Cr (Rs.)

Depreciation A/c...................Dr. 8,000

To Machinery A/c 8,000

(Being depreciation charged on

machinery)

Here depreciation is loss for organization, so it is debited and it reduces the value of

machinery (i.e. fixed assets) so machinery is credited.

Payment of expenses

Salaries for the month Rs. 15,000 paid.

Date Particulars LF Dr (Rs.) Cr (Rs.)

Salary A/c...............................Dr. 15,000

To Cash A/c 15,000

(Being salary paid )

Here salary is expense and related to nominal A/c. In nominal account, expenses are

to be debited so, salary A/c is debited and cash goes out, so cash A/c is credited being

real A/c.

Outstanding Expenses

Rent outstanding Rs. 7000.

Date Particulars LF Dr (Rs.) Cr (Rs.)

Rent A/c.............................Dr. 7000

To Outstanding Rent A/c

(Being rent outstanding) 7000

Here, rent is still to be paid and it should be added to rent expenses, so rent is debited.

Outstanding rent means increase in liabilities and it is credited.

Prepaid expenses

Salary prepaid Rs. 2,500

Date Particulars LF Dr (Rs.) Cr (Rs.)

Prepaid Salary A/c.................Dr. 2500

To Cash A/c

(Being Salary paid in advance) 2500

116 Office Practice and Accounting 9