Page 122 - Office Practice and Accounting -9

P. 122

Here goods given as free sample refers to the expenses of business firm and should be

debited to advertisement account and purchase is credited because there is decrease

in purchased goods.

Illustrations:

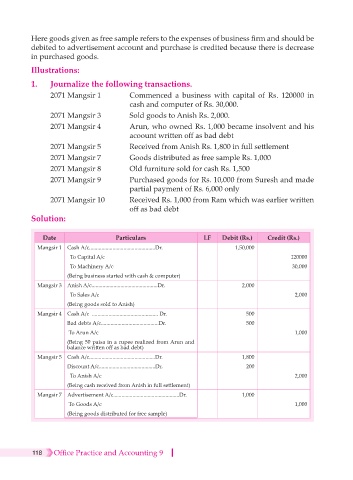

1. Journalize the following transactions.

2071 Mangsir 1 Commenced a business with capital of Rs. 120000 in

cash and computer of Rs. 30,000.

2071 Mangsir 3 Sold goods to Anish Rs. 2,000.

2071 Mangsir 4 Arun, who owned Rs. 1,000 became insolvent and his

acoount written off as bad debt

2071 Mangsir 5 Received from Anish Rs. 1,800 in full settlement

2071 Mangsir 7 Goods distributed as free sample Rs. 1,000

2071 Mangsir 8 Old furniture sold for cash Rs. 1,500

2071 Mangsir 9 Purchased goods for Rs. 10,000 from Suresh and made

partial payment of Rs. 6,000 only

2071 Mangsir 10 Received Rs. 1,000 from Ram which was earlier written

off as bad debt

Solution:

Date Particulars LF Debit (Rs.) Credit (Rs.)

Mangsir 1 Cash A/c................................................Dr. 1,50,000

To Capital A/c 120000

To Machinery A/c 30,000

(Being business started with cash & computer)

Mangsir 3 Anish A/c................................................Dr. 2,000

To Sales A/c 2,000

(Being goods sold to Anish)

Mangsir 4 Cash A/c ................................................ Dr. 500

Bad debts A/c..........................................Dr. 500

To Arun A/c 1,000

(Being 50 paisa in a rupee realized from Arun and

balance written off as bad debt)

Mangsir 5 Cash A/c................................................Dr. 1,800

Discount A/c.........................................Dr. 200

To Anish A/c 2,000

(Being cash received from Anish in full settlement)

Mangsir 7 Advertisement A/c................................................Dr. 1,000

To Goods A/c 1,000

(Being goods distributed for free sample)

118 Office Practice and Accounting 9