Page 124 - Office Practice and Accounting -9

P. 124

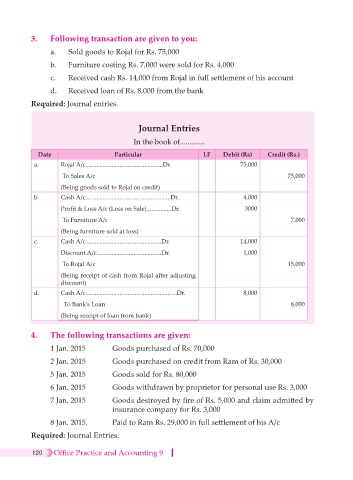

3. Following transaction are given to you:

a. Sold goods to Rojal for Rs. 75,000

b. Furniture costing Rs. 7,000 were sold for Rs. 4,000

c. Received cash Rs. 14,000 from Rojal in full settlement of his account

d. Received loan of Rs. 8,000 from the bank

Required: Journal entries.

Journal Entries

In the book of.............

Date Particular LF Debit (Rs) Credit (Rs.)

a. Rojal A/c..................................................Dr. 75,000

To Sales A/c 75,000

(Being goods sold to Rojal on credit)

b. Cash A/c .......................................................Dr. 4,000

Profit & Loss A/c (Loss on Sale)................Dr. 3000

To Furniture A/c 7,000

(Being furniture sold at loss)

c. Cash A/c .................................................Dr. 14,000

Discount A/c..........................................Dr. 1,000

To Rojal A/c 15,000

(Being receipt of cash from Rojal after adjusting

discount)

d. Cash A/c ...........................................................Dr. 8,000

To Bank’s Loan 8,000

(Being receipt of loan from bank)

4. The following transactions are given:

1 Jan. 2015 Goods purchased of Rs. 70,000

2 Jan. 2015 Goods purchased on credit from Ram of Rs. 30,000

5 Jan. 2015 Goods sold for Rs. 80,000

6 Jan. 2015 Goods withdrawn by proprietor for personal use Rs. 3,000

7 Jan. 2015 Goods destroyed by fire of Rs. 5,000 and claim admitted by

insurance company for Rs. 3,000

8 Jan. 2015, Paid to Ram Rs. 29,000 in full settlement of his A/c

Required: Journal Entries.

120 Office Practice and Accounting 9