Page 121 - Office Practice and Accounting -9

P. 121

Here, salary is paid in advance. Expenses advance is assets, so it is debited. On the

other hand, cash is going outside, so it is credited.

Income receipts

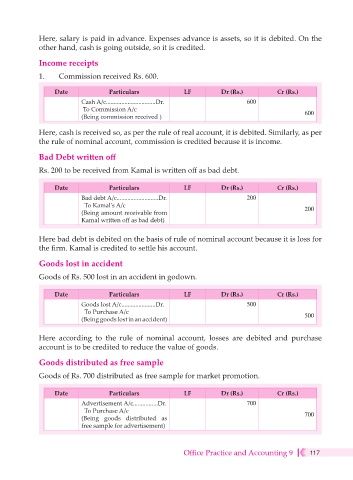

1. Commission received Rs. 600.

Date Particulars LF Dr (Rs.) Cr (Rs.)

Cash A/c................................ Dr. 600

To Commission A/c 600

(Being commission received )

Here, cash is received so, as per the rule of real account, it is debited. Similarly, as per

the rule of nominal account, commission is credited because it is income.

Bad Debt written off

Rs. 200 to be received from Kamal is written off as bad debt.

Date Particulars LF Dr (Rs.) Cr (Rs.)

Bad debt A/c...........................Dr. 200

To Kamal's A/c 200

(Being amount receivable from

Kamal written off as bad debt)

Here bad debt is debited on the basis of rule of nominal account because it is loss for

the firm. Kamal is credited to settle his account.

Goods lost in accident

Goods of Rs. 500 lost in an accident in godown.

Date Particulars LF Dr (Rs.) Cr (Rs.)

Goods lost A/c......................Dr. 500

To Purchase A/c 500

(Being goods lost in an accident)

Here according to the rule of nominal account, losses are debited and purchase

account is to be credited to reduce the value of goods.

Goods distributed as free sample

Goods of Rs. 700 distributed as free sample for market promotion.

Date Particulars LF Dr (Rs.) Cr (Rs.)

Advertisement A/c................Dr. 700

To Purchase A/c 700

(Being goods distributed as

free sample for advertisement)

Office Practice and Accounting 9 117