Page 108 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 108

NOTES TO THE FINANCIAL STATEMENTS (CONT.)

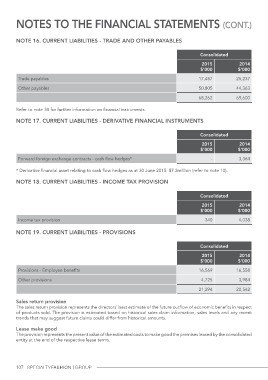

Note 16. Current liabilities - trade and other payables

Trade payables Consolidated 2014

Other payables 2015 $’000

$’000

17,457 25,237

50,805 44,363

68,262 69,600

Refer to note 30 for further information on financial instruments.

Note 17. Current liabilities - derivative financial instruments

Forward foreign exchange contracts - cash flow hedges* Consolidated 2014

$’000

2015

$’000 3,364

-

* Derivative financial asset relating to cash flow hedges as at 30 June 2015: $7.3million (refer to note 10).

Note 18. Current liabilities - income tax provision

Income tax provision Consolidated 2014

$’000

Note 19. Current liabilities - provisions 2015

$’000 4,038

340

Provisions - Employee benefits Consolidated 2014

Other provisions 2015 $’000

$’000

16,569 16,558

4,725 3,984

21,294 20,542

Sales return provision

The sales return provision represents the directors’ best estimate of the future outflow of economic benefits in respect

of products sold. The provision is estimated based on historical sales claim information, sales levels and any recent

trends that may suggest future claims could differ from historical amounts.

Lease make good

The provision represents the present value of the estimated costs to make good the premises leased by the consolidated

entity at the end of the respective lease terms.

107