Page 107 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 107

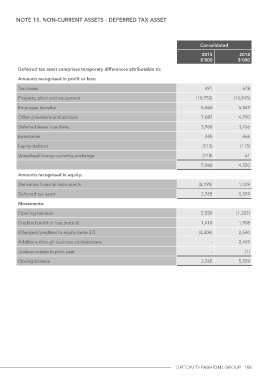

Note 15. Non-current assets - deferred tax asset Consolidated 2014

$’000

Deferred tax asset comprises temporary differences attributable to: 2015

Amounts recognised in profit or loss: $’000

Tax losses

Property, plant and equipment 491 678

Employee benefits (10,752) (10,945)

Other provisions and accruals

Deferred lease incentives 5,060 5,849

Inventories 7,087 4,790

Lay-by debtors 3,960 3,766

Unrealised foreign currency exchange

345 466

Amounts recognised in equity: (113) (115)

Derivative financial instruments (118)

Deferred tax asset 5,960 61

Movements: 4,550

Opening balance (2,195)

Credited profit or loss (note 6) 3,765 1,009

(Charged)/credited to equity (note 27) 5,559

Additions through business combinations 5,559

Underprovision in prior year 1,410 (1,337)

Closing balance (3,204) 1,908

2,540

- 2,449

- (1)

3,765 5,559

106