Page 111 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 111

Consolidated 2014

$’000

2015

$’000

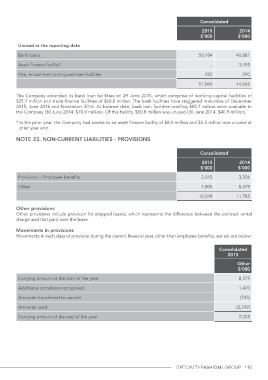

Unused at the reporting date 50,784 40,881

Bank loans - 3,495

Asset finance facility* 290

Visa, encashment and guarantee facilities 282

51,066 44,666

The Company amended its bank loan facilities on 29 June 2015, which comprise of working capital facilities of

$25.7 million and trade finance facilities of $60.0 million. The bank facilities have staggered maturities of December

2015, June 2016 and November 2016. At balance date, bank loan facilities totalling $85.7 million were available to

the Company (30 June 2014: $70.0 million). Of this facility, $50.8 million was unused (30 June 2014: $40.9 million).

* In the prior year, the Company had access to an asset finance facility of $8.0 million and $3.5 million was unused at

prior year end.

Note 23. Non-current liabilities - provisions

Provisions - Employee benefits Consolidated 2014

Other 2015 $’000

$’000

3,243 3,206

7,005 8,579

10,248 11,785

Other provisions

Other provisions include provision for stepped leases, which represents the difference between the contract rental

charge and that paid over the lease.

Movements in provisions

Movements in each class of provision during the current financial year, other than employee benefits, are set out below:

Carrying amount at the start of the year Consolidated

Additional provisions recognised 2015

Amounts transferred to current Other

Amounts used $’000

Carrying amount at the end of the year

8,579

1,470

(725)

(2,319)

7,005

110