Page 115 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 115

The consolidated entity would look to raise capital when an opportunity to invest in a business or company was seen

as value adding relative to the current company’s share price at the time of the investment. The consolidated entity

is not actively pursuing additional investments in the short term as it continues to integrate and grow its existing

businesses in order to maximise synergies.

The consolidated entity is subject to certain financing arrangement covenants and meeting these is given priority in

all capital risk management decisions. There have been no events of default on the financing arrangements during the

financial year. Formal notification of this compliance is confirmed on a quarterly basis.

The capital structure of the consolidated entity consists of net debt (borrowings as detailed in note 22 offset by cash

and cash equivalents as detailed in note 7) and equity of the consolidated entity (comprising issued capital, reserves

and accumulated losses as detailed in notes 26 to 29).

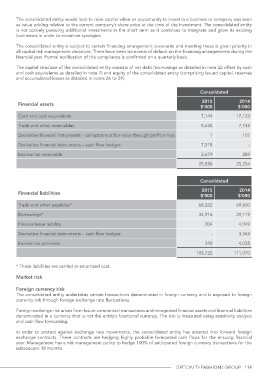

Financial assets Consolidated 2014

2015 $’000

Cash and cash equivalents $’000 17,123

Trade and other receivables 7,144 7,735

Derivative financial instruments – call options at fair value through profit or loss 8,438

Derivative financial instruments – cash flow hedges 107

Income tax receivable 1 -

7,318

2,679 289

25,580 25,254

Consolidated

Financial liabilities 2015 2014

$’000 $’000

Trade and other payables*

Borrowings* 68,262 69,600

Finance lease liability

Derivative financial instruments – cash flow hedges 34,916 29,119

Income tax provision

204 4,949

- 3,364

340 4,038

103,722 111,070

* These liabilities are carried at amortised cost.

Market risk

Foreign currency risk

The consolidated entity undertakes certain transactions denominated in foreign currency and is exposed to foreign

currency risk through foreign exchange rate fluctuations.

Foreign exchange risk arises from future commercial transactions and recognised financial assets and financial liabilities

denominated in a currency that is not the entity’s functional currency. The risk is measured using sensitivity analysis

and cash flow forecasting.

In order to protect against exchange rate movements, the consolidated entity has entered into forward foreign

exchange contracts. These contracts are hedging highly probable forecasted cash flows for the ensuing financial

year. Management has a risk management policy to hedge 100% of anticipated foreign currency transactions for the

subsequent 18 months.

114