Page 117 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 117

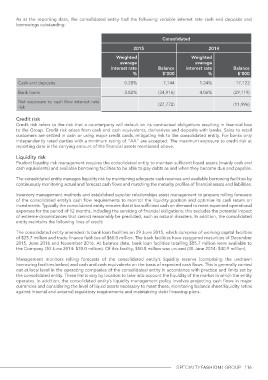

As at the reporting date, the consolidated entity had the following variable interest rate cash and deposits and

borrowings outstanding:

Consolidated

2015 Balance 2014 Balance

$’000 $’000

Weighted Weighted 17,123

average average

(29,119)

interest rate interest rate

% % (11,996)

Cash and deposits 0.28% 7,144 1.24%

Bank loans 3.82% (34,916) 4.06%

Net exposure to cash flow interest rate (27,772)

risk

Credit risk

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial loss

to the Group. Credit risk arises from cash and cash equivalents, derivatives and deposits with banks. Sales to retail

customers are settled in cash or using major credit cards, mitigating risk to the consolidated entity. For banks only

independently rated parties with a minimum rating of “AA” are accepted. The maximum exposure to credit risk at

reporting date is the carrying amount of the financial assets mentioned above.

Liquidity risk

Prudent liquidity risk management requires the consolidated entity to maintain sufficient liquid assets (mainly cash and

cash equivalents) and available borrowing facilities to be able to pay debts as and when they become due and payable.

The consolidated entity manages liquidity risk by maintaining adequate cash reserves and available borrowing facilities by

continuously monitoring actual and forecast cash flows and matching the maturity profiles of financial assets and liabilities.

Inventory management methods and established supplier relationships assist management to prepare rolling forecasts

of the consolidated entity’s cash flow requirements to monitor the liquidity position and optimise its cash return on

investments. Typically the consolidated entity ensures that it has sufficient cash on demand to meet expected operational

expenses for the period of 12 months, including the servicing of financial obligations; this excludes the potential impact

of extreme circumstances that cannot reasonably be predicted, such as natural disasters. In addition, the consolidated

entity maintains the following lines of credit:

The consolidated entity amended its bank loan facilities on 29 June 2015, which comprise of working capital facilities

of $25.7 million and trade finance facilities of $60.0 million. The bank facilities have staggered maturities of December

2015, June 2016 and November 2016. At balance date, bank loan facilities totalling $85.7 million were available to

the Company (30 June 2014: $70.0 million). Of this facility, $50.8 million was unused (30 June 2014: $40.9 million).

Management monitors rolling forecasts of the consolidated entity’s liquidity reserve (comprising the undrawn

borrowing facilities below) and cash and cash equivalents on the basis of expected cash flows. This is generally carried

out at local level in the operating companies of the consolidated entity in accordance with practice and limits set by

the consolidated entity. These limits vary by location to take into account the liquidity of the market in which the entity

operates. In addition, the consolidated entity’s liquidity management policy involves projecting cash flows in major

currencies and considering the level of liquid assets necessary to meet these, monitoring balance sheet liquidity ratios

against internal and external regulatory requirements and maintaining debt financing plans.

116